If you’re new to investing, mutual funds can feel confusing. You may have wondered: “What if I lose money? Where does my money go? Are mutual funds really safe for beginners?”

The good news is that mutual funds are actually one of the simplest, safest, and most convenient ways to grow your wealth. This mutual fund guide for beginners is designed to remove all confusion and help you start investing confidently.

Mutual funds offer professional management, diversification, and low-cost entry — making them perfect even if you’re a complete beginner. By the end of this guide, you’ll clearly understand “what mutual funds are”, “how they work”, and “how to start investing step by step”.

Let’s begin with the basics.

What Is a Mutual Fund?

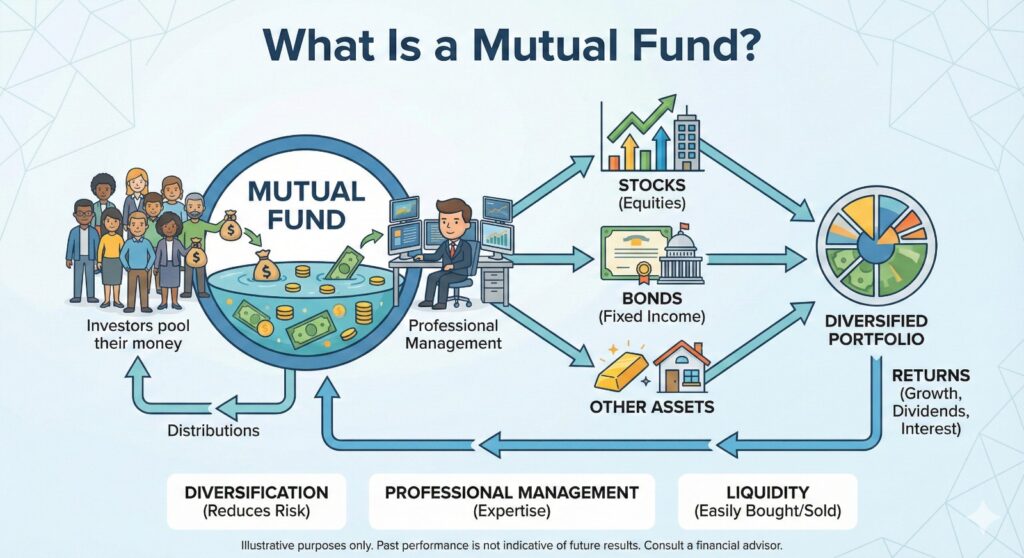

A mutual fund is a professionally managed investment pool that collects money from many investors and invests that money into a diversified portfolio of assets like “stocks, bonds, gold”, and more.

Think of it like a “shared taxi ride”: instead of buying and driving your own car (picking your own stocks), you’re sharing the ride with others going in the same direction. It’s safer, easier, and cost-efficient.

Each mutual fund is managed by a “fund manager”, a financial expert responsible for choosing where to invest the pooled money. Their job includes market research, risk management, and adjusting the portfolio to generate the best possible returns.

In India, mutual funds are regulated by “SEBI (Securities and Exchange Board of India)”, which ensures transparency and protects investors. This makes mutual funds one of the most trusted investment vehicles for beginners.

Why Mutual Funds Are Great for Beginners

Mutual funds are ideal for first-time investors because they offer:

- Low Investment Requirement

Start with as little as “₹500 through SIP” (Systematic Investment Plan). No need for huge savings.

- Professional Expertise

You don’t need stock market knowledge. Fund managers handle everything.

- Diversification

Your money is invested across multiple assets — reducing risk.

- High Liquidity

You can redeem most mutual funds anytime (except ELSS).

- Transparent & Regulated

NAVs, portfolios, and performance reports are publicly available.

This makes mutual funds the most beginner-friendly investment option in India.

Types of Mutual Funds

One of the most common questions beginners ask is: “Which mutual fund should I start with?”

To answer that, here’s a quick and simple breakdown.

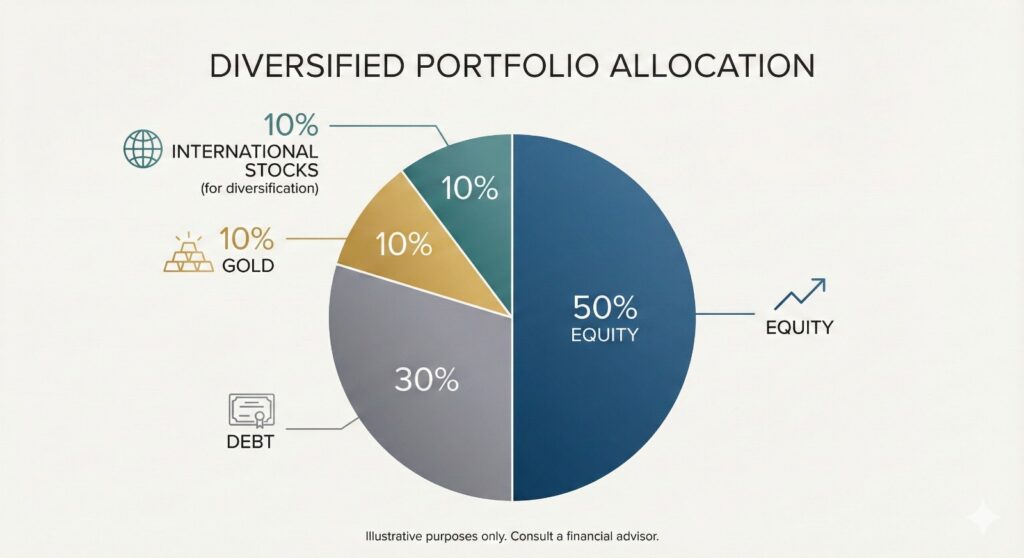

1. Equity Funds

– Invest mainly in “company stocks”

– Best for “long-term goals (5+ years)”

– Higher risk, higher returns

“Best for:” retirement, wealth creation, children’s education

2. Debt Funds

– Invest in “government bonds, corporate bonds, treasury bills”

– Lower risk than equity funds

– Suitable for short-term goals

“Best for:” emergency fund, buying a car, planning a trip

3. Hybrid Funds

– Mix of “equity + debt”

– Balance between risk and return

– Ideal for moderate investors

“Best for:” someone who wants growth but also stability

4. Index Funds

– Track popular market indices like “Nifty 50” or “Sensex”

– Low-cost, passive, and beginner-friendly

– Very popular for long-term investing

“Best for:” passive investors, long-term wealth building

5. ELSS (Tax-Saving Funds)

– Equity-based funds with “tax benefits under Section 80C”

– Comes with a “3-year lock-in”

– High return potential + tax savings

“Best for:” tax planning + long-term investment

Know More about ELSS: https://www.instagram.com/p/DQeXflBDEKs/

Note for Beginners

You don’t need to master all fund categories on Day 1. Choose a fund that aligns with your goals and risk appetite.

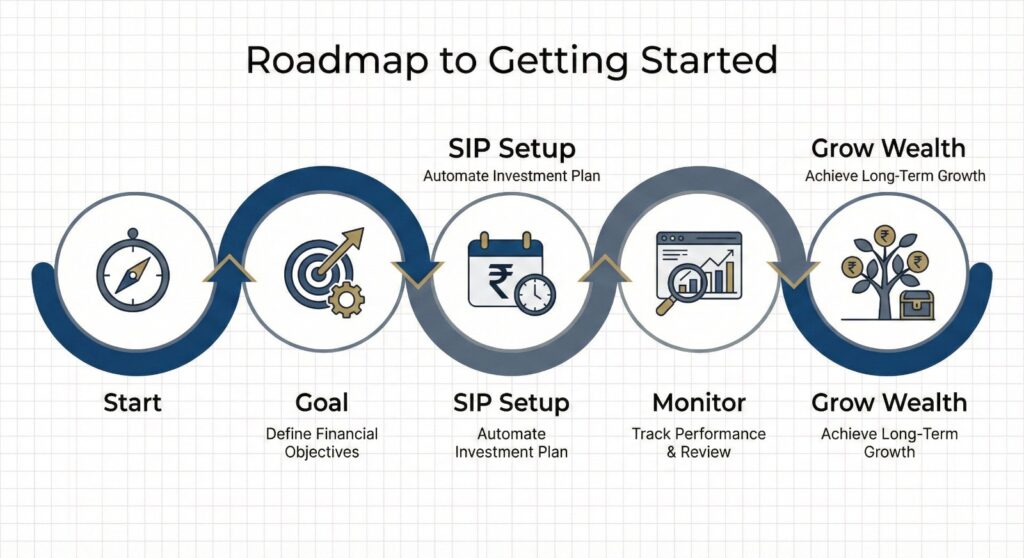

Step-by-Step Guide: How to Invest in Mutual Funds

Here is the easiest and most practical step-by-step “mutual fund investing guide for beginners”.

Step 1: Set a Financial Goal

Ask yourself:

– Why am I investing?

– How soon do I need the money?

“Long-term goals (5–15 years):” equity funds, index funds

“Short term goals (1–3 years):” debt funds

Step 2: Know Your Risk Profile

Your choice of mutual fund depends heavily on your risk appetite:

– “Conservative:” Debt Funds

– “Moderate:” Hybrid Funds

– “Aggressive:” Equity & Index Funds

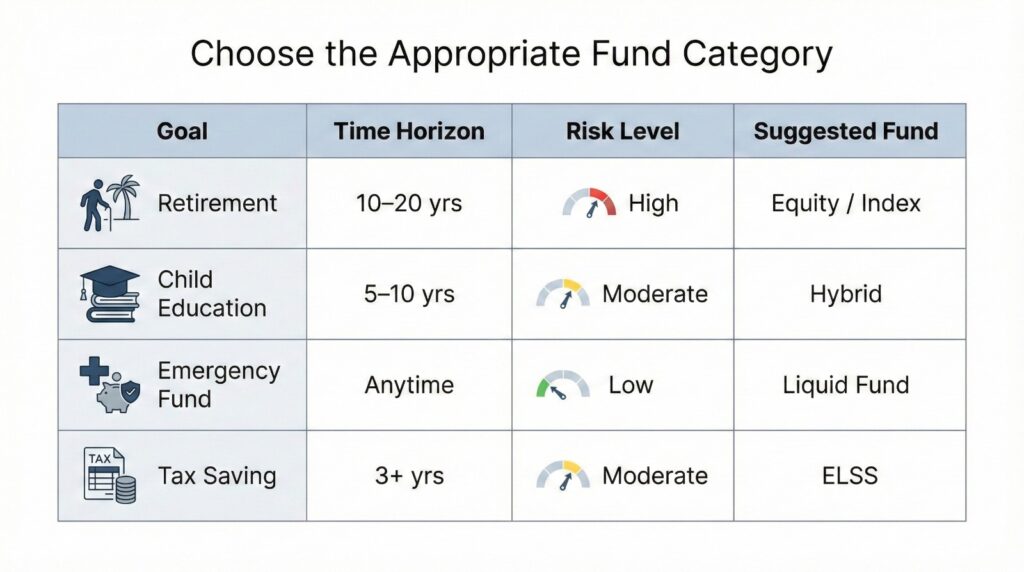

Step 3: Choose the Appropriate Fund Category

| Goal | Duration | Risk | Recommended Fund |

| Retirement | 10–20 years | High | Equity / Index Funds |

| Child’s Education | 5–10 years | Moderate | Hybrid Fund |

| Emergency Fund | Anytime | Low | Liquid/Overnight Funds |

| Vacation / Car | 2–3 years | Low | Debt Funds |

| Tax Saving | 3+ years | Moderate | ELSS |

Step 4: Complete KYC

To invest in mutual funds, you’ll need:

– PAN Card

– Aadhaar

– Bank account

– Mobile number linked to Aadhaar

You can complete KYC easily on platforms like:

– Groww

– Zerodha Coin

– Paytm Money

– MF Central

– Kuvera

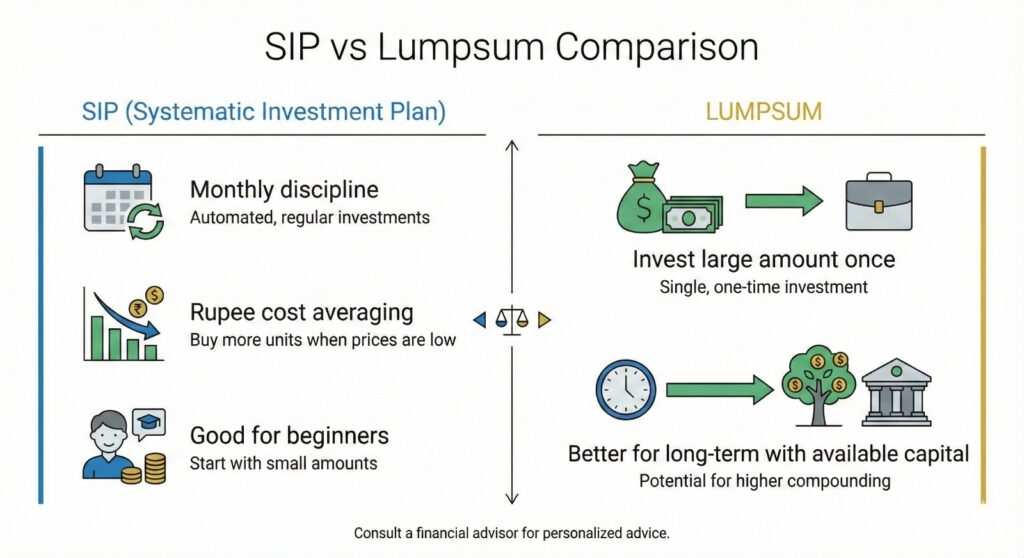

Step 5: Start Investing – SIP or Lumpsum?

Read More: https://wealthfitlife.com/5-best-platforms-to-start-a-sip/

Step 6: Monitor Your Investments

Check your funds:

– Every “6–12 months”

– Compare with benchmark

– Avoid panic during short-term volatility

How to Select the Best Mutual Fund for You

When choosing a fund, check:

- 3–5 Year Performance

- Compare returns with other funds in the same category.

Expense Ratio

- Lower expense ratio = better long-term returns.

Fund Manager Track Record

- Experienced managers usually maintain consistent performance.

Fund House Reputation

- Choose AMCs with strong governance and long history.

Prefer Direct Plans

- Direct plans have lower charges than regular plans.

If unsure, consult a financial advisor for personalized guidance.

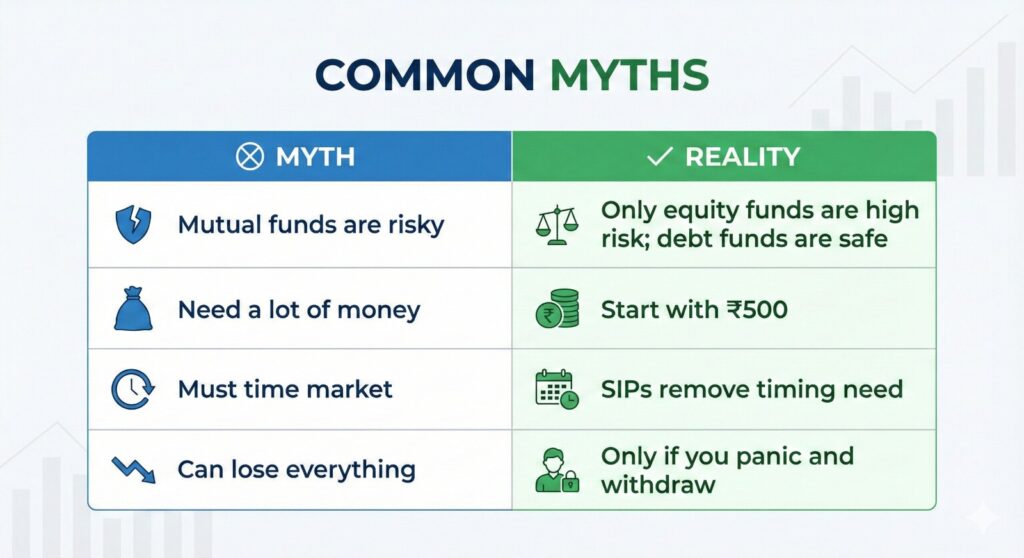

Common Myths About Mutual Funds

Let’s clear the misunderstandings many beginners have:

❌ “Mutual funds are risky.”

Risk depends on fund type. Debt funds, for example, are low risk.

❌ “I need a lot of money to invest.”

You can start with “₹500 SIP”.

❌ “I must time the market.”

SIPs eliminate the need to time markets — you invest regularly.

❌ “I can lose all my money.”

Only if you panic and withdraw during a market drop. Long-term investing usually recovers.

Mistakes Beginners Should Avoid

Avoid these common investing mistakes:

– Investing without a clear financial goal

– Stopping SIPs due to market volatility

– Choosing funds based only on past returns

– Not reviewing portfolio annually

– Investing all money into one fund type

Avoiding these mistakes alone improves your investment outcomes significantly.

How a Financial Consultant Helps New Investors

If you’re a beginner, choosing among 2,000+ mutual funds can feel overwhelming. This is where a financial consultant adds real value.

A consultant helps by:

– Assessing your risk profile

– Understanding your financial goals

– Recommending the right funds

– Monitoring your portfolio

– Avoiding costly mistakes

If you need guidance choosing the best mutual fund for beginners, I can help you get started confidently.

Conclusion: Start Your Mutual Fund Journey Today

Mutual funds are not just for experts—they are for anyone who wants to grow wealth steadily and safely. Whether you’re saving for a dream home, planning retirement, or just starting your financial journey, mutual funds give you the flexibility, growth, and simplicity you need.

Remember:

– Start early

– Invest consistently

– Choose funds based on your goals

– Stay patient

Your Next Steps:

– Download the “Free SIP Starter Checklist”

– Read the “SIP vs FD Comparison Guide”

– Book a “Free Investment Consultation”

Your journey to smart investing begins today. Mutual funds make it easy, all you need is the first step.