Building a diversified investment portfolio is key to managing risk and maximizing returns over time. Diversification helps spread risk across different asset classes, reducing the impact of a single investment’s poor performance. In this guide, we’ll walk you through the steps to create a well-balanced investment portfolio tailored to your financial goals and risk tolerance.

Why Diversification is Important

Diversification minimizes the risk associated with market volatility. By investing in multiple asset classes, industries, and geographies, you reduce the chances of losing all your capital if one sector underperforms. A diversified portfolio ensures stability and enhances long-term growth potential.

Steps to Build a Diversified Investment Portfolio

1. Assess Your Risk Tolerance

Your risk tolerance depends on factors such as your age, financial situation, and investment goals. Conservative investors may prefer bonds and fixed-income securities, while aggressive investors might lean towards stocks and alternative assets.

2. Allocate Assets Strategically

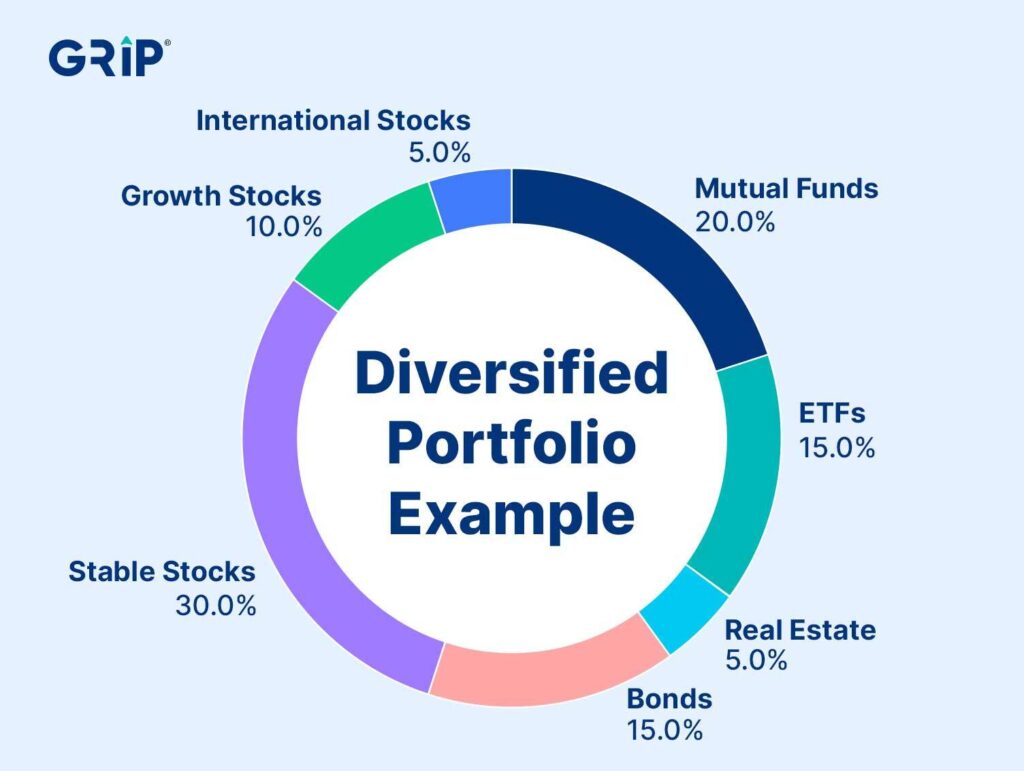

A well-diversified portfolio typically includes:

- Stocks: Growth potential but higher volatility

- Bonds: Stable returns with lower risk

- Real Estate: Tangible assets providing passive income

- Commodities: Gold, silver, or oil for inflation hedging

- Cryptocurrency: High-risk, high-reward digital assets

- Mutual Funds & ETFs: Managed funds offering broad market exposure

3. Diversify Within Each Asset Class

Even within a single asset class, diversification is crucial. For example:

- Stocks: Invest in different industries (technology, healthcare, finance, etc.)

- Bonds: Consider government, corporate, and municipal bonds

- Real Estate: Residential, commercial, and REITs (Real Estate Investment Trusts)

4. Consider Global Investments

Investing in international markets helps mitigate risks associated with a single economy’s downturn. Emerging markets often offer high growth potential, while developed markets provide stability.

5. Rebalance Your Portfolio Regularly

Market fluctuations can shift your asset allocation. Reviewing and rebalancing your portfolio ensures it aligns with your investment goals. If stocks outperform and take up a larger percentage, consider reallocating funds to other asset classes to maintain balance.

6. Invest in Low-Cost Funds

High fees can eat into your returns over time. Exchange-traded funds (ETFs) and index funds often provide low-cost diversification compared to actively managed funds.

7. Keep an Emergency Fund

While investing is crucial, maintaining an emergency fund (3-6 months’ worth of expenses) ensures you won’t need to liquidate investments during downturns.

Conclusion

A diversified investment portfolio helps minimize risk and enhances long-term financial stability. By strategically allocating assets, diversifying within asset classes, and regularly rebalancing your investments, you can build a resilient portfolio suited to your financial objectives. Start small, stay consistent, and watch your wealth grow over time.

Read More: https://wealthfitlife.com/best-investment-strategies-for-2025-where-to-put-your-money/

FAQs

1. How much should I invest in each asset class? The ideal allocation depends on your risk tolerance and investment horizon. A common rule of thumb is the 60/40 rule (60% stocks, 40% bonds), but younger investors may lean towards higher stock allocations.

2. Is real estate a good addition to a diversified portfolio? Yes, real estate offers passive income and a hedge against inflation, making it a valuable addition.

3. How often should I rebalance my portfolio? It’s recommended to review and rebalance your portfolio at least once a year or whenever your asset allocation significantly shifts.

By following these principles, you can achieve financial growth while mitigating risks, ensuring a secure future for your investments.