Investing for the first time often brings up one common question: should I choose SIP or FD? For many beginners, this decision feels confusing because both options seem safe, popular, and widely recommended.

Fixed Deposits feel familiar and secure, while SIPs promise better growth but come with market-linked uncertainty. As a first-time investor, it’s natural to hesitate — not because you lack money, but because you want to make the right choice.

This sip vs fd guide is designed to clear that confusion. We’ll break down how each option works, how they differ in returns, risk, flexibility, and taxes, and which one suits different financial goals.

If you’re starting your money journey and want clarity without jargon, this comparison will help you decide confidently — based on your needs, not assumptions or fear.

What Is SIP?

A SIP (Systematic Investment Plan) is a way of investing a fixed amount of money regularly — usually every month — into a mutual fund. Instead of investing a large sum at once, SIPs help you invest gradually and consistently.

When you start a SIP, the chosen amount is automatically invested at regular intervals. This builds a habit of disciplined investing and removes the pressure of deciding when to invest. Over time, your money benefits from rupee cost averaging and compounding.

SIPs are especially popular among first-time investors because they make investing feel manageable. You can start with small amounts, stay consistent, and allow time to do the heavy lifting — without needing to track markets daily or make complex decisions.

For beginners comparing sip vs fd, SIPs represent a shift from just saving money to growing it over the long term, while still keeping the process simple and structured.

What Is FD?

An FD (Fixed Deposit) is a traditional saving option where you deposit a lump sum with a bank or financial institution for a fixed period at a predetermined interest rate. The return is known in advance, which is why FDs feel safe and predictable.

Once you invest in an FD, your money is locked in for the chosen tenure. At maturity, you receive the original amount along with the interest earned. This certainty makes FDs popular among first-time investors who prioritise capital protection over growth.

FDs don’t depend on market movements, so returns remain stable regardless of economic conditions. However, this also means the growth potential is limited, especially after accounting for inflation and taxes.

In the sip vs fd comparison, FDs represent security and stability, while SIPs focus on long-term growth. Understanding this difference is key before deciding which option suits your financial goals.

SIP vs FD: Key Differences at a Glance

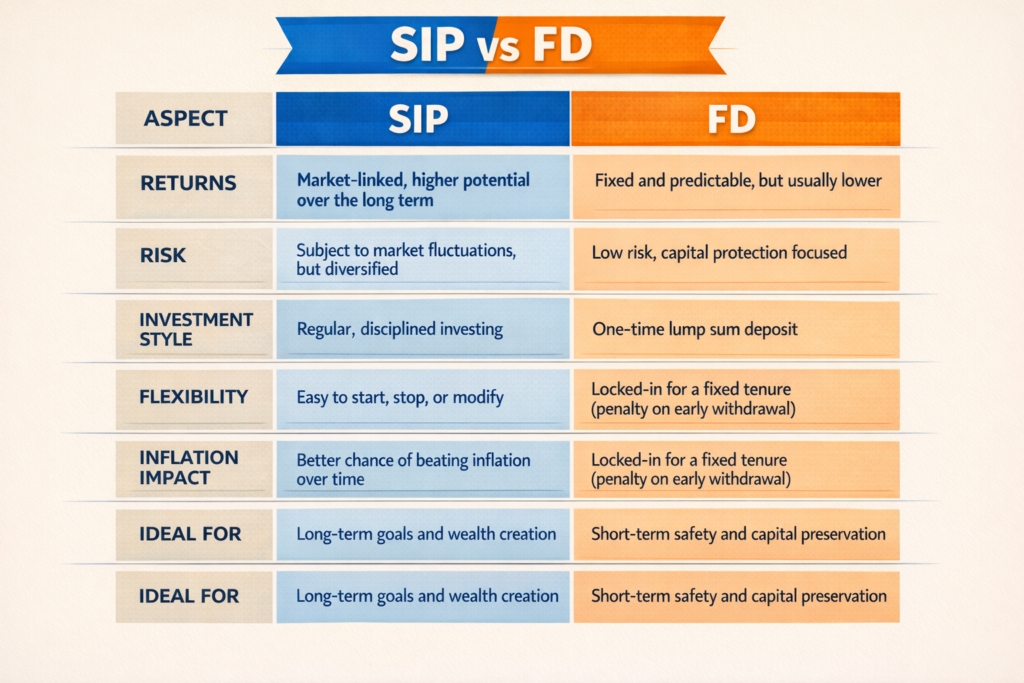

When comparing sip vs fd, it helps to look at both options side by side. While both are popular with first-time investors, they serve very different purposes and suit different financial needs.

SIP vs FD – Quick Comparison

This snapshot makes one thing clear: sip vs fd is not about which is better overall, but which is better for you. Your goals, time horizon, and comfort with risk should drive the decision — not just familiarity or fear.

SIP vs FD: Returns Comparison

Returns are often the deciding factor when first-time investors compare sip vs fd. While both options help you grow money, the way they generate returns is very different.

SIP returns depend on market performance and the type of mutual fund you choose. Over the long term, equity-based SIPs have the potential to deliver higher, inflation-beating returns, especially when investments are held consistently for several years.

FD returns, on the other hand, are fixed and predictable. You know exactly how much interest you’ll earn, which offers comfort and certainty. However, FD returns are usually lower and may struggle to beat inflation after tax.

Key points to keep in mind:

- SIP returns grow with time and consistency

- FD returns remain fixed regardless of tenure

- Inflation impacts FD returns more strongly

- Compounding works better with long-term SIPs

In the sip vs fd debate, SIPs favour growth over time, while FDs prioritise certainty. Understanding this difference helps set realistic expectations and avoid disappointment later.

SIP vs FD: Risk & Safety

Risk and safety are major concerns for first-time investors comparing sip vs fd. Fixed Deposits are considered safer because they offer capital protection and predictable returns, unaffected by market movements. This makes FDs suitable for those who value certainty and short-term stability.

SIPs, however, are market-linked, which means returns can fluctuate in the short term. But SIPs invest in diversified mutual funds, spreading risk across multiple assets instead of relying on a single investment. Over time, this diversification helps manage risk more effectively than it may appear initially.

Key safety considerations:

- FDs: Low risk, fixed returns, predictable outcomes

- SIPs: Market-linked risk, but professionally managed and diversified

- Time factor: Longer investment horizons reduce SIP volatility

- Goal alignment: Safety depends on matching the option to your goal

In the sip vs fd comparison, safety doesn’t mean zero risk — it means choosing an option that aligns with your time horizon, comfort level, and financial objectives.

SIP vs FD: Tax Treatment

Taxation is an important factor that many first-time investors overlook when comparing sip vs fd. While both options generate returns, the way those returns are taxed is very different.

Interest earned from FDs is fully taxable as per your income tax slab. This means the higher your income, the more tax you pay on FD interest, which can significantly reduce your actual returns.

SIPs, being linked to mutual funds, follow capital gains taxation. For equity mutual funds, long-term gains are taxed at a lower rate, making SIPs more tax-efficient when held for longer periods.

Key tax differences to note:

- FDs: Interest taxed every year as income

- SIPs: Tax applies only when you redeem

- Equity SIPs: Lower tax on long-term gains

- Holding period matters: Longer stays improve tax efficiency

In the sip vs fd decision, understanding tax impact helps you see which option truly helps your money grow after taxes — not just on paper.

SIP vs FD: Which Is Better for First-Time Investors?

When deciding between sip vs fd, there’s no single right answer for everyone. The better option depends on your goals, time horizon, and comfort with risk. What matters is choosing what suits your situation, not what feels familiar.

Choose SIP if:

- You’re investing for long-term goals like wealth creation

- You want your money to beat inflation over time

- You’re comfortable with short-term ups and downs

- You prefer disciplined, monthly investing

Choose FD if:

- You need short-term safety and certainty

- You’re parking money temporarily

- You have a low risk tolerance

- You want predictable returns

For most first-time investors, SIPs work better for long-term growth, while FDs are useful for stability and short-term needs. That’s why the sip vs fd decision isn’t about choosing one forever — it’s about using each option for the right purpose.

Can Beginners Use Both SIP and FD?

Yes — in many cases, using both SIP and FD together is the smartest approach. The sip vs fd decision doesn’t have to be an either–or choice, especially for first-time investors.

SIPs and FDs serve different purposes, and when used thoughtfully, they bring balance to your financial plan.

A simple way beginners can use both:

- Use FDs for emergency funds or short-term goals

- Use SIPs for long-term wealth creation

- Keep safety money separate from growth money

- Increase SIP amounts gradually as confidence grows

This balanced approach reduces stress and helps beginners stay invested without fear — shifting the focus from sip vs fd to using each tool where it fits best.

SIP vs FD: Common Mistakes

When comparing sip vs fd, beginners often make decisions based on fear, familiarity, or incomplete information. These mistakes can limit growth or create unnecessary stress early in the investing journey.

Common mistakes to avoid:

- Choosing FDs only because they feel safe, without considering inflation

- Expecting SIPs to give fixed or short-term returns like FDs

- Stopping SIPs during market dips due to panic

- Locking all savings into FDs, leaving no room for growth

- Ignoring tax impact while comparing returns

- Making decisions based on advice without understanding suitability

Avoiding these mistakes helps first-time investors stay consistent, realistic, and confident. The goal isn’t to pick the “perfect” option in the sip vs fd debate — it’s to make informed choices that support long-term financial progress.

Final Verdict: SIP vs FD for Beginners

When it comes to sip vs fd, the better option depends on what you’re investing for. SIPs are ideal for long-term goals where growth and inflation protection matter. FDs work well for short-term needs where safety and certainty are the priority.

For most first-time investors, starting with SIPs builds discipline and long-term wealth, while FDs provide stability and peace of mind. The smartest approach isn’t choosing one over the other forever — it’s using each where it fits best.

Start small, stay consistent, and align your choice with your goals. That’s how confident investing begins.

Not Sure What’s Right for You?

If you’re still confused about choosing between SIP and FD, you’re not alone. Every income, goal, and risk comfort is different — and that’s where personalised guidance helps.

Instead of guessing, get clear, customised advice based on your situation, so you can invest with confidence and peace of mind.