🤖 AI & Machine Learning in Investment Management: Practical Use Cases 📈

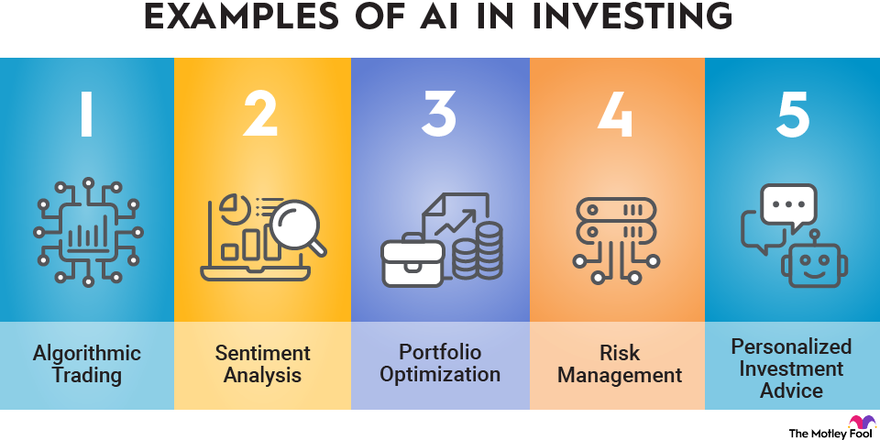

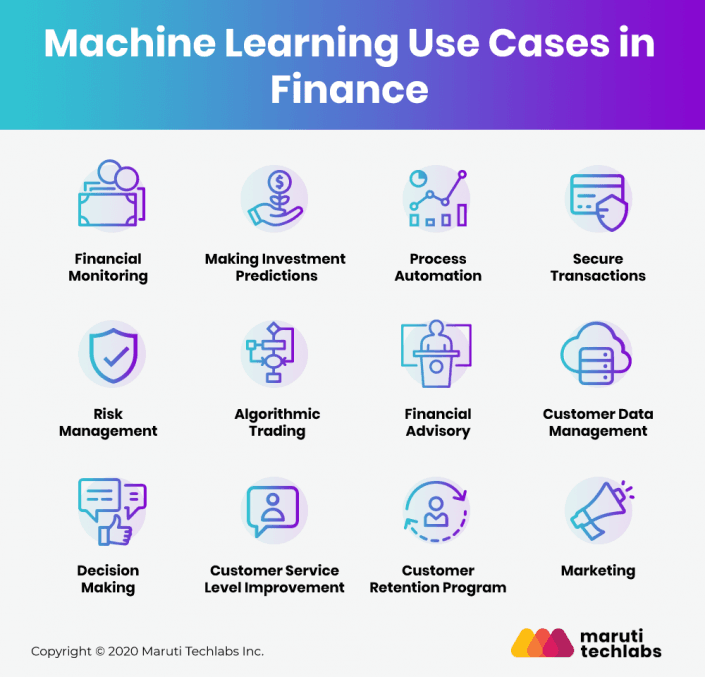

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing investment management by automating complex tasks, enhancing decision-making, and optimizing portfolio performance. Here’s a detailed exploration of their practical applications, supported by academic research and real-world examples.

🔍 1. Robo-Advisors: Personalized Portfolio Management

Robo-advisors utilize ML algorithms to assess individual investor profiles and construct tailored portfolios. These platforms continuously learn from market data to adjust asset allocations, ensuring alignment with clients’ financial goals and risk tolerances. Studies have shown that such AI-driven systems can outperform traditional investment strategies by adapting to market changes more swiftly .Coursera+2StartUs Insights+2Plat.AI+2

📊 2. Predictive Analytics for Asset Price Forecasting

AI models, including deep learning and recurrent neural networks, analyze vast datasets to predict asset price movements. These predictive capabilities assist investors in making informed decisions about buying or selling assets, potentially enhancing returns and minimizing risks .A3Logics

⚠️ 3. Risk Management and Fraud Detection

AI enhances risk management by identifying potential threats through pattern recognition in historical and real-time data. Additionally, ML algorithms detect anomalies in transaction patterns, aiding in the prevention of fraudulent activities .ResearchGate

📈 4. Hierarchical Risk Parity (HRP) for Portfolio Optimization

HRP is an advanced ML framework that constructs diversified portfolios by clustering assets based on their correlations. This method addresses the limitations of traditional mean-variance optimization, offering more robust and stable portfolio allocations .ResearchGate+5Wikipedia+5arXiv+5

🧠 5. Deep Reinforcement Learning in Portfolio Management

Deep reinforcement learning (DRL) applies AI to optimize investment strategies by learning from market interactions. DRL models have demonstrated the ability to outperform benchmarks like the S&P 500 by adapting to market conditions and minimizing transaction costs .

📚 6. AI-Driven Research and Due Diligence

AI accelerates the due diligence process by analyzing financial reports, news articles, and market data to provide comprehensive insights into potential investments. This capability enhances the efficiency and accuracy of investment research .Miquido

🏦 7. Operational Automation in Investment Firms

Investment banks and firms are leveraging AI to automate routine tasks such as data analysis, document processing, and compliance monitoring. This automation reduces operational costs and allows professionals to focus on strategic decision-making .Financial News

💬 8. AI in Client Relationship Management

AI-powered chatbots and virtual assistants enhance client interactions by providing personalized investment advice and 24/7 support. These tools improve customer satisfaction and streamline communication between clients and financial advisors .Michalsons

🧾 9. Algorithmic and High-Frequency Trading

AI enables algorithmic trading by identifying market patterns and executing trades at optimal times. High-frequency trading firms utilize AI to make thousands of trades per second, capitalizing on minute price differences .Wikipedia+3Coursera+3Miquido+3Miquido

🧠 10. AI in Wealth Management

Wealth management firms employ AI to create customized investment strategies that consider clients’ financial goals, risk preferences, and personal values. AI-driven platforms provide wealth managers with deep insights into client profiles, enhancing the advisory process and delivering better client outcomes .Miquido

✅ Conclusion

AI and ML are transforming investment management by automating processes, enhancing decision-making, and optimizing portfolio performance. Their applications span from personalized portfolio management to fraud detection and operational automation. As these technologies continue to evolve, their integration into investment strategies is expected to deepen, offering more efficient and effective solutions for investors.

Read more:https://wealthfitlife.com/the-role-of-cognitive-biases-in-portfolio-underperformance/

❓ FAQs

- What is a robo-advisor?

- A robo-advisor is an AI-driven platform that provides automated, algorithm-based financial planning services with minimal human supervision.

- How does AI predict asset prices?

- AI uses machine learning models to analyze historical data, economic indicators, and market trends to forecast future asset prices.A3Logics+1StartUs Insights+1

- What is Hierarchical Risk Parity?

- HRP is a machine learning-based portfolio optimization method that clusters assets based on their correlations, aiming for better diversification and reduced risk.Wikipedia

- Can AI detect financial fraud?

- Yes, AI systems can analyze transaction patterns to identify anomalies and potential fraudulent activities in real-time.Michalsons

- What is deep reinforcement learning in finance?

- DRL is a type of machine learning where an agent learns to make investment decisions by interacting with the market environment, aiming to maximize returns.

- How does AI assist in investment research?

- AI accelerates the research process by analyzing large volumes of financial data, news, and reports to provide actionable insights.Miquido

- What tasks can AI automate in investment firms?

- AI can automate tasks such as data analysis, document processing, compliance monitoring, and client interactions.

- What is algorithmic trading?

- Algorithmic trading involves using AI algorithms to execute trades at optimal times based on market data and trends.Miquido

- How does AI personalize wealth management?

- AI personalizes wealth management by analyzing clients’ financial goals, risk tolerance, and preferences to create tailored investment strategies.

- What are the benefits of AI in investment management?

- AI offers benefits such as improved decision-making, enhanced risk management, operational efficiency, and personalized client services.

📚 Academic References

- Financial Machine Learning

Kelly, B. T., & Xiu, D. (2023). This comprehensive survey explores the integration of machine learning techniques in financial markets, highlighting their applications in asset pricing, portfolio selection, and risk management. NBER - Machine Learning in Business and Finance: A Literature Review and Research Opportunities

Financial Innovation, 2024. This review critically analyzes over 100 articles, emphasizing the dominance of deep learning methods in financial contexts and discussing challenges like interpretability and data quality. SpringerOpen - Machine Learning for Financial Forecasting, Planning, and Analysis: Recent Developments and Pitfalls

Digital Finance, 2021. This article examines the use of ML in financial forecasting and planning, cautioning against its naive application and advocating for frameworks like double machine learning to address causal inference. SpringerLink - Artificial Intelligence and Machine Learning in Finance: A Bibliometric Review

Research in International Business and Finance, 2022. This bibliometric review analyzes 348 articles on AI and ML in finance, identifying key applications such as bankruptcy prediction, stock price forecasting, and anti-money laundering. ScienceDirect - Recent Advances in Reinforcement Learning in Finance

arXiv, 2021. This paper surveys the application of reinforcement learning in finance, covering areas like portfolio optimization, option pricing, and robo-advising, and discussing the challenges and opportunities in these domains.