Introduction

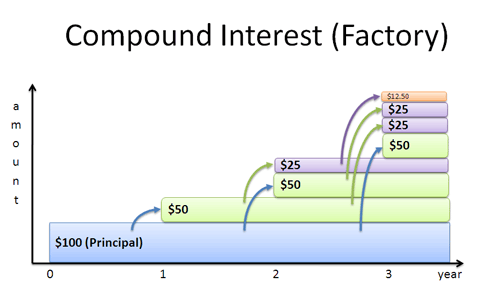

Have you ever heard the phrase, “Money makes money”? That’s essentially what compound interest is all about. It’s the principle of earning interest not just on your initial investment but also on the interest that your money earns over time. In simple terms, compound interest helps your money grow faster than simple interest.

Whether you’re saving for retirement, your child’s education, or just looking to grow your wealth, understanding compound interest is key to making smarter financial decisions. In this article, we’ll break it down into easy-to-understand terms, show you real-life examples, and explain how you can harness this powerful financial tool.

What Is Compound Interest?

Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. It’s like a snowball rolling downhill: as it rolls, it gathers more snow, and the bigger it gets, the faster it grows.

Formula:

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount

- r = annual interest rate (in decimal)

- n = number of times the interest is compounded per year

- t = number of years the money is invested or borrowed for

Compound Interest vs. Simple Interest

| Feature | Compound Interest | Simple Interest |

|---|---|---|

| Interest On | Principal + Accumulated Interest | Only Principal |

| Growth Rate | Exponential | Linear |

| Long-Term Advantage | Higher Returns | Lower Returns |

| Best For | Long-Term Investing, Retirement Funds | Short-Term Loans |

Real-Life Example

Let’s say you invest $1,000 at an interest rate of 5% annually, compounded annually.

Growth Over Time:

| Year | Amount ($) |

| 1 | 1,050 |

| 2 | 1,102.50 |

| 3 | 1,157.63 |

| 4 | 1,215.51 |

| 5 | 1,276.28 |

After 5 years, your investment grows to $1,276.28 without adding a single dollar more.

Now imagine if you keep adding money regularly. The effect multiplies!

To know more Visit:https://www.youtube.com/watch?v=wf91rEGw88Q

Why Compound Interest is So Powerful

1. Time is Your Best Friend

The earlier you start investing, the more your money can grow. Even small amounts can lead to big gains over time.

2. Reinvesting Earnings

By letting your returns stay invested, your money can compound more quickly.

3. Exponential Growth

The growth isn’t just steady — it accelerates. That’s what makes compound interest so powerful for long-term goals.

Chart: Compound Interest Growth Over 30 Years

Let’s assume an initial investment of $5,000 at 7% interest, compounded annually.

Year,Value

0,5000

5,7012

10,9853

15,13842

20,19435

25,27357

30,38550Source: Investor.gov Compound Interest Calculator

How to Take Advantage of Compound Interest

1. Start Early

Even if it’s just $50/month, starting in your 20s will yield more than starting in your 30s or 40s.

2. Stay Consistent

Set up automatic contributions to your investment accounts.

3. Reinvest Your Earnings

Don’t withdraw your interest – let it grow.

4. Use a Compound Interest Calculator

You can easily forecast your investments using online tools.

Recommended Tool: Compound Interest Calculator – Investor.gov

Conclusion

Compound interest is one of the most powerful forces in finance. The earlier and more consistently you invest, the more you can benefit from the exponential growth it offers. It rewards patience, discipline, and long-term thinking.

Whether you’re building a retirement fund or simply trying to grow your wealth, understanding and using compound interest is one of the smartest moves you can make.

Read More:https://wealthfitlife.com/how-ai-is-revolutionizing-stock-market-predictions-in-2025/

FAQs About Compound Interest

1. What is compound interest in simple terms?

Compound interest is interest calculated on both the money you put in and the interest that has already been added to it.

2. Why is compound interest better than simple interest?

Because it grows your investment faster by adding interest on top of interest.

3. How often is interest compounded?

It can be compounded annually, semi-annually, quarterly, monthly, or even daily.

4. How do I calculate compound interest manually?

Use the formula:

5. Can compound interest make you rich?

Yes, with time and consistency, compound interest can significantly increase your wealth.

6. What type of accounts use compound interest?

Savings accounts, CDs, retirement accounts, and some investment vehicles.

7. Is compound interest good or bad?

It’s good when you’re investing or saving, but can be bad if you’re on the borrowing side.

8. How do I maximize compound interest?

Start early, invest regularly, reinvest earnings, and avoid withdrawals.

9. What is the rule of 72?

It estimates how long it takes to double your money at a fixed interest rate. Divide 72 by your interest rate.

10. Is compound interest taxed?

Yes, unless it’s in a tax-advantaged account like an IRA or 401(k).

Remember: The key to growing your money is not timing the market but time in the market.