📈 The Rise of Tactical Asset Allocation: Beyond 60/40 Portfolios

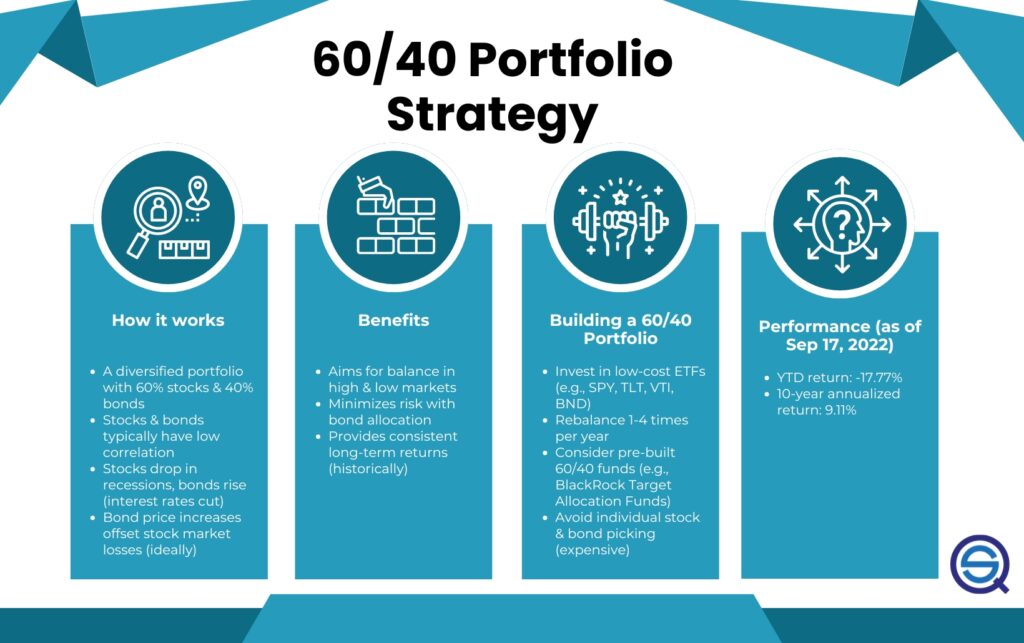

The traditional 60/40 portfolio—comprising 60% equities and 40% bonds—has long been the cornerstone of investment strategies, particularly for retirement planning. However, evolving market dynamics, such as low bond yields, high equity valuations, and rising inflation, have prompted investors and institutions to reconsider this approach. Tactical Asset Allocation (TAA) has emerged as a compelling alternative, offering a more dynamic and responsive investment strategy.

🔍 What Is Tactical Asset Allocation?

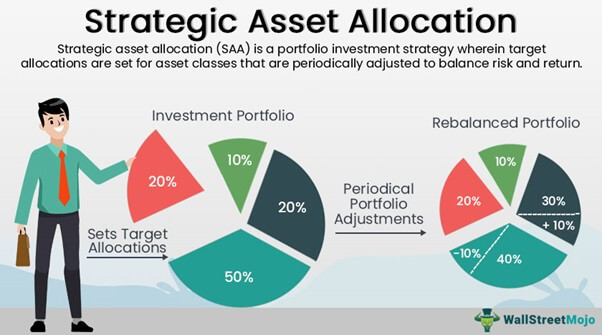

Tactical Asset Allocation is an active investment strategy that involves adjusting the weightings of various asset classes—such as equities, bonds, commodities, and real estate—based on short-term market forecasts. Unlike Strategic Asset Allocation, which maintains a fixed allocation over the long term, TAA seeks to capitalize on market opportunities and mitigate risks by making periodic adjustments.

📉 The Limitations of the 60/40 Portfolio

While the 60/40 portfolio has historically provided a balance between risk and return, several factors have diminished its effectiveness:

- Low Bond Yields: Persistently low interest rates have reduced the income generated from bonds, making them less effective as a stabilizing force during market downturns.

- High Equity Valuations: Elevated stock prices increase the potential for market corrections, raising concerns about the sustainability of equity returns.

- Inflation Risks: Rising inflation erodes purchasing power and can negatively impact both bond prices and equity valuations.

These factors have led to periods where the 60/40 portfolio underperformed, prompting a reevaluation of its suitability in modern investment environments .

🚀 The Advantages of Tactical Asset Allocation

Tactical Asset Allocation offers several benefits over traditional strategies:

- Enhanced Flexibility: TAA allows investors to adjust their portfolios in response to changing market conditions, potentially improving returns and reducing risk.

- Diversification: By incorporating a broader range of asset classes, TAA can provide more comprehensive diversification, reducing the impact of adverse movements in any single market.

- Risk Management: TAA enables investors to shift allocations away from overvalued or high-risk assets, potentially protecting portfolios from downturns .

🧠 Academic Perspectives on Tactical Asset Allocation

Academic research supports the efficacy of Tactical Asset Allocation:

- A study by Aked et al. (2018) demonstrated that incorporating value, momentum, and carry strategies into a diversified TAA approach resulted in significant risk-adjusted returns .

- Louton et al. (2015) found that TAA strategies could be effectively implemented in pension plans, offering potential for improved performance compared to static allocations .

These findings indicate that TAA can be a viable strategy for both individual and institutional investors seeking to enhance portfolio performance.

🏦 Institutional Adoption of Tactical Asset Allocation

Institutional investors have increasingly adopted Tactical Asset Allocation strategies:

- The California Public Employees’ Retirement System (CalPERS) increased its allocation to private equity and private credit, reducing exposure to traditional equities and bonds .

- Research Affiliates, in collaboration with firms like PIMCO and Schwab, has developed TAA-based financial products that have outperformed traditional benchmarks .

These examples illustrate the growing confidence in TAA among large-scale investors.

🔄 Implementing Tactical Asset Allocation

Implementing a Tactical Asset Allocation strategy involves:

- Market Analysis: Assessing economic indicators, market trends, and valuation metrics to identify opportunities and risks.

- Asset Selection: Choosing asset classes and securities that align with the identified market outlook.

- Portfolio Adjustment: Regularly rebalancing the portfolio to reflect changes in market conditions and investment objectives.

Tools such as exchange-traded funds (ETFs) and mutual funds can facilitate the implementation of TAA strategies, offering liquidity and cost efficiency .

✅ Conclusion

The traditional 60/40 portfolio, while historically effective, may no longer suffice in today’s complex and dynamic financial landscape. Tactical Asset Allocation provides a flexible and responsive approach, enabling investors to navigate market fluctuations and enhance portfolio performance. By integrating TAA strategies, investors can better align their portfolios with current economic realities and future opportunities.

❓ Frequently Asked Questions (FAQs)

- What is Tactical Asset Allocation (TAA)?

Tactical Asset Allocation is a dynamic investment strategy that allows portfolio managers to deviate from a long-term asset mix to exploit short- to medium-term market opportunities. - How does TAA differ from Strategic Asset Allocation?

Strategic Asset Allocation maintains a fixed allocation based on long-term investment goals, while TAA adjusts allocations more frequently in response to market conditions. - Why is the 60/40 portfolio model being reconsidered?

The 60/40 model is under scrutiny due to persistently low bond yields, overvalued equities, and rising inflation, which together limit the model’s ability to deliver balanced risk-adjusted returns. - Can TAA improve risk-adjusted returns?

Yes, academic studies have shown that TAA, especially when combined with factors like value, momentum, and carry, can improve Sharpe ratios compared to static strategies (Aked et al., 2018). - What asset classes are typically used in TAA?

TAA strategies often include equities, bonds, commodities, real estate, and alternative assets such as hedge funds or private equity. - Is TAA more suited to individual or institutional investors?

While initially popular with institutions, TAA has gained traction with retail investors through mutual funds and ETFs designed to implement tactical strategies. - What tools support TAA implementation?

TAA strategies are often implemented using exchange-traded funds (ETFs), actively managed funds, and portfolio management software that analyzes market indicators. - What are the risks associated with Tactical Asset Allocation?

Key risks include timing errors, increased trading costs, potential tax consequences, and reliance on accurate market forecasting. - How often are adjustments made in a TAA strategy?

Portfolio adjustments in TAA are typically made quarterly or monthly, but some strategies rebalance even more frequently depending on market signals. - Has TAA outperformed traditional models in recent years?

Research and performance data suggest that many TAA strategies have outperformed the traditional 60/40 allocation in volatile or low-return environments, particularly post-2008 and during COVID-19 volatility.

📚 References (Academic and Industry Sources)

- Aked, M., & Mazzoleni, R. (2018). The End of 60/40? The Case for Diversified Value, Momentum, and Carry Risk Exposures. Research Affiliates.

https://academicinsightsoninvesting.com/2018/02/the-end-of-60-40 - Louton, D. A., & Tufano, M. (2015). Tactical Asset Allocation for Pension Plans. Journal of Asset Management, 16(6), 431–440.

https://link.springer.com/article/10.1057/jam.2015.26 - Wall Street Journal. (2021). Is the 60/40 Portfolio Dead? Not So Fast.

https://www.wsj.com/finance/investing/60-40-portfolio-retirement-61716c4d - Financial Planning Association. (2024). Is It Time for Investors to Look Beyond 60/40 Portfolios?

https://www.financialplanningassociation.org/learning/publications/journal - Barron’s. (2024). Research Affiliates Chairman on AI, Investing Strategies, and More.

https://www.barrons.com - LPL Financial. (2023). Long Live Tactical Asset Allocation.

https://www.lpl.com/research/blog/tactical-asset-allocation-long-live-the-60-40.html - Arnott, R. D., & Bernstein, P. L. (2002). What Risk Premium is “Normal”? Financial Analysts Journal, 58(2), 64–85.

https://www.cfainstitute.org - Ilmanen, A. (2011). Expected Returns: An Investor’s Guide to Market Forecasting. Wiley Finance.

https://www.wiley.com - BlackRock. (2023). Rethinking Portfolio Construction Beyond 60/40.

https://www.blackrock.com - Vanguard. (2022). Forecasting Stock and Bond Returns: Challenges for TAA Models.

https://www.vanguard.com