📊 Quantitative vs. Qualitative Investment Analysis: When and How to Use Each 🧠

Investing isn’t just about crunching numbers or reading annual reports—it’s about understanding the full picture. Two primary approaches to investment analysis are quantitative and qualitative methods. Each offers unique insights and has its own strengths and limitations. This article delves into both approaches, helping you determine when and how to use each effectively.Investingly+2FasterCapital+2FasterCapital+2Investingly

📈 What Is Quantitative Investment Analysis?

Quantitative analysis involves evaluating investments using numerical data and mathematical models. It’s rooted in the belief that past market behavior and financial metrics can predict future performance.

🔍 Key Features:

- Data-Driven: Utilizes historical data, financial ratios, and statistical models.

- Objective: Reduces emotional bias by focusing on hard numbers.

- Tools: Employs software like Excel, R, Python, and platforms such as Bloomberg Terminal.

📊 Common Techniques:

- Financial Ratios: P/E ratio, debt-to-equity, return on equity.

- Statistical Models: Regression analysis, Monte Carlo simulations.

- Risk Metrics: Value at Risk (VaR), Conditional VaR.SecuritiesExamsMastery.ca+1Investopedia+1

✅ Advantages:

- Scalability: Can analyze vast amounts of data quickly.

- Consistency: Provides repeatable and verifiable results.

- Backtesting: Allows testing of strategies against historical data.SecuritiesExamsMastery.ca+1FasterCapital+1

⚠️ Limitations:

- Historical Bias: Past performance may not predict future results.

- Model Risk: Flawed models can lead to significant losses.

- Lack of Context: Overlooks qualitative factors like management quality.IIPSSecuritiesExamsMastery.ca+1WIRED+1Investingly+3Investopedia+3IIPS+3

🧠 What Is Qualitative Investment Analysis?

Qualitative analysis focuses on non-numerical factors that can influence an investment’s potential. It emphasizes understanding the “why” behind financial outcomes.IIPS

🔍 Key Features:

- Subjective: Relies on judgment, experience, and insights.

- Contextual: Considers industry trends, company culture, and leadership quality.

- Tools: Interviews, surveys, expert opinions, and case studies.FasterCapital

🧩 Common Techniques:

- Management Evaluation: Assessing leadership effectiveness and vision.

- Industry Analysis: Understanding market dynamics and competitive landscape.

- Sentiment Analysis: Evaluating public perception and brand strength.Kingsgate

✅ Advantages:

- Holistic View: Captures factors that numbers can’t.

- Adaptability: Can quickly adjust to new information or changes.

- Predictive Power: Useful for forecasting long-term trends.Kingsgate+5IIPS+5YouTube+5IIPS+2Investopedia+2FasterCapital+2

⚠️ Limitations:

- Bias: Subjective assessments can be influenced by personal opinions.

- Inconsistency: Difficult to standardize and replicate.

- Time-Consuming: Requires extensive research and analysis.FasterCapital

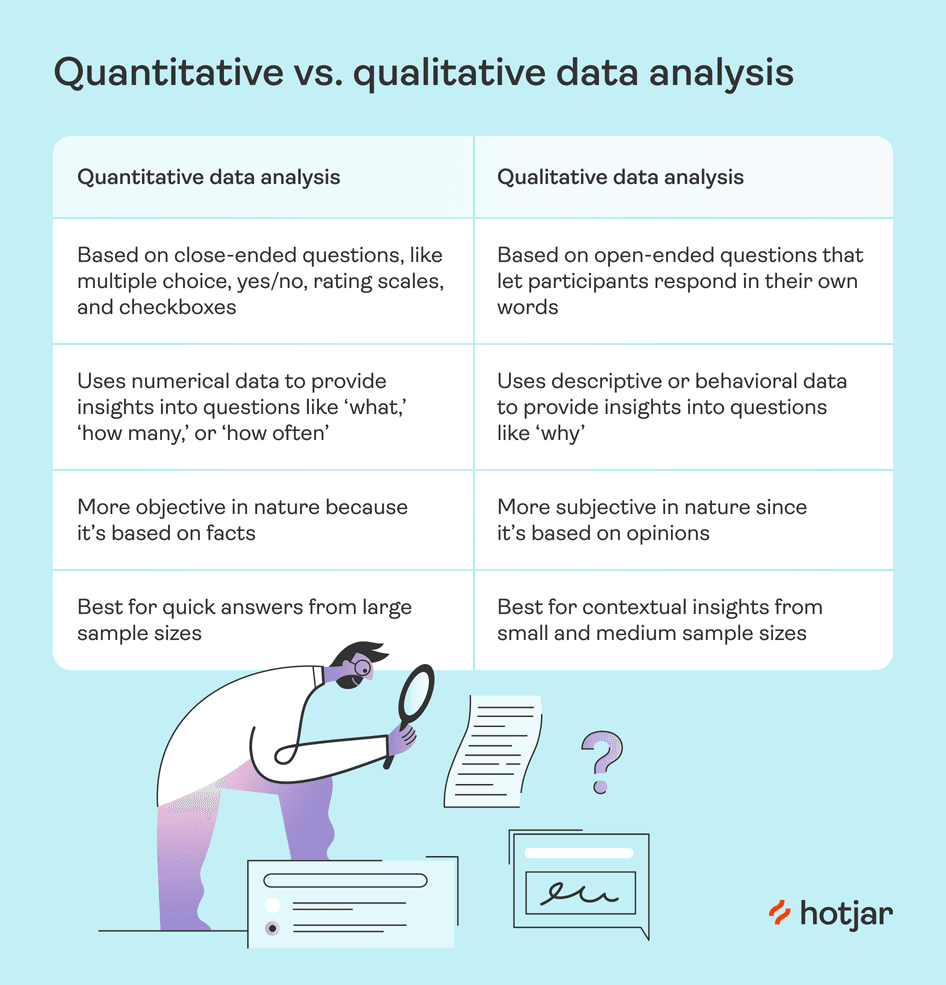

⚖️ Quantitative vs. Qualitative: A Comparative Overview

| Feature | Quantitative Analysis | Qualitative Analysis |

|---|---|---|

| Nature | Numerical, objective | Descriptive, subjective |

| Data Type | Financial statements, market data | Interviews, reports, expert opinions |

| Focus | “What” happened and “how much” | “Why” it happened and “what it means” |

| Tools Used | Algorithms, statistical models | Case studies, expert judgment |

| Time Horizon | Short to medium-term | Long-term |

| Risk Assessment | Based on historical data and metrics | Based on judgment and contextual factors |

🧩 When to Use Quantitative Analysis

- Evaluating Financial Health: Use financial ratios and metrics to assess profitability, liquidity, and solvency.

- Comparing Investment Options: Screen stocks or bonds based on performance indicators.

- Risk Assessment: Apply statistical models to estimate potential losses and volatility.

- Algorithmic Trading: Develop automated trading strategies based on historical data patterns.Investopedia+13IIPS+13FasterCapital+13WIRED+6Investopedia+6IIPS+6

🧠 When to Use Qualitative Analysis

- Assessing Management Quality: Evaluate leadership effectiveness and strategic vision.

- Understanding Market Trends: Analyze industry dynamics and consumer behavior.

- Evaluating Company Culture: Understand organizational values and employee satisfaction.

- Sentiment Analysis: Gauge public perception and brand strength.

🔄 Integrating Both Approaches: A Balanced Strategy

Successful investors often combine both quantitative and qualitative analyses to make informed decisions. For instance, while quantitative analysis can identify undervalued stocks based on financial metrics, qualitative analysis can provide insights into the company’s future prospects and potential risks.

📚 Conclusion

Both quantitative and qualitative analyses are essential tools in the investor’s toolkit. Quantitative analysis offers precision and objectivity, while qualitative analysis provides depth and context. By understanding when and how to use each approach, investors can make more informed and balanced investment decisions.

Read More:https://wealthfitlife.com/easiest-countries-to-buy-property-abroad-as-a-foreigner-2025/

❓ Frequently Asked Questions (FAQs)

- What is the main goal of quantitative investment analysis?

The goal is to use numerical and statistical methods to evaluate investments and optimize portfolio performance using data-driven techniques. - When should an investor prioritize qualitative analysis over quantitative?

When assessing subjective factors like management quality, corporate governance, and strategic positioning—especially in emerging industries or startups. - Can qualitative analysis be standardized like quantitative models?

Not easily. Qualitative analysis often relies on expert judgment and is more difficult to systematize or backtest. - What are examples of qualitative data in investing?

Interviews with executives, brand strength, innovation capacity, customer loyalty, and market sentiment. - How reliable are quantitative models in volatile markets?

They can break down during black swan events or unexpected shocks, especially if they rely on assumptions from historical stability (Taleb, 2007). - Can qualitative insights be converted into data?

Yes—via methods like Natural Language Processing (NLP), sentiment analysis, or scoring frameworks, though nuance can be lost. - Which approach is better for short-term trading?

Quantitative analysis is generally preferred for short-term strategies due to its precision and speed. - Are machine learning models part of quantitative analysis?

Yes. They represent a more advanced subset of quantitative analysis, using algorithms to detect patterns in large datasets (Gu et al., 2020). - Do institutional investors use both methods?

Absolutely. Most large investment firms and hedge funds integrate both approaches to make comprehensive decisions. - Is qualitative analysis becoming obsolete with AI?

No—AI enhances it by organizing and analyzing unstructured data, but human interpretation and strategic thinking remain vital.

📚 References

- Gu, S., Kelly, B., & Xiu, D. (2020). Empirical Asset Pricing via Machine Learning. The Review of Financial Studies, 33(5), 2223–2273. https://doi.org/10.1093/rfs/hhaa009

- Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset (3rd ed.). Wiley.

- Taleb, N. N. (2007). The Black Swan: The Impact of the Highly Improbable. Random House.

- CFA Institute. (2020). Quantitative Investment Analysis (3rd ed.). Wiley.

- Lo, A. W. (2002). The Adaptive Markets Hypothesis: Market Efficiency from an Evolutionary Perspective. Journal of Portfolio Management, 30(5), 15–29.

- Fama, E. F., & French, K. R. (1993). Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics, 33(1), 3–56.

- Buffett, W. (1997). Berkshire Hathaway Annual Shareholder Letter – Discussion of qualitative vs. quantitative analysis.

- Koller, T., Goedhart, M., & Wessels, D. (2020). Valuation: Measuring and Managing the Value of Companies (7th ed.). McKinsey & Company.

- Shiller, R. J. (2000). Irrational Exuberance. Princeton University Press.

- Jegadeesh, N., & Titman, S. (1993). Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance, 48(1), 65–91.