🌍📊 Macro-Driven Investing: Interpreting Economic Indicators for Portfolio Allocation

✨ Introduction

In an era marked by economic volatility and shifting market dynamics, investors are increasingly turning to macro-driven investing strategies. This approach involves analyzing broad economic indicators—such as GDP growth, inflation rates, employment figures, and central bank policies—to inform portfolio allocation. By understanding these forces, investors can better align their portfolios with prevailing macroeconomic conditions, potentially enhancing returns and mitigating risk (Friedman & Laibson, 2021).

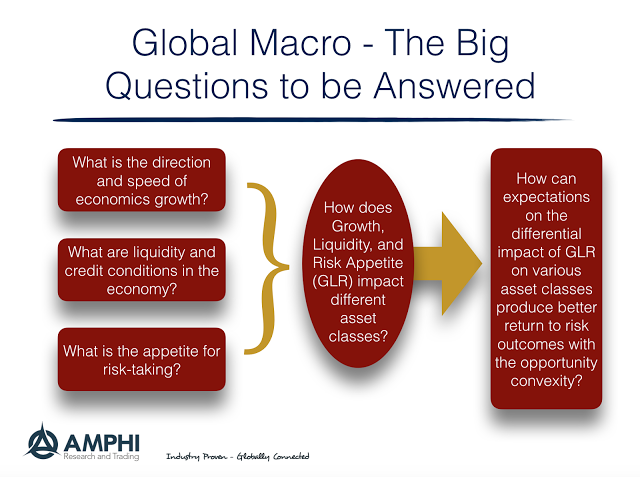

🔍 Understanding Macro-Driven Investing

Macro-driven investing emphasizes the analysis of global economic trends rather than company-specific metrics. Unlike bottom-up investing, which focuses on individual securities, macro investing evaluates factors like interest rates, global trade, and political risk. Institutional investors, including hedge funds and sovereign wealth funds, often employ this strategy to navigate complex economic landscapes (Ilmanen, 2011).

📈 Key Economic Indicators for Portfolio Allocation

🧮 1. Gross Domestic Product (GDP)

GDP is a comprehensive measure of a nation’s economic activity. A rising GDP typically indicates economic growth, which benefits equity markets, while a contracting GDP may point to recessionary conditions, influencing a shift toward safer assets like bonds or gold (Mankiw, 2019).

💸 2. Inflation Rates

Inflation gauges the rate of increase in prices. Central banks often respond to rising inflation by increasing interest rates, which can dampen stock market performance and decrease bond prices. Investors may shift to inflation-protected securities (e.g., TIPS) during inflationary periods (Mishkin, 2018).

👷 3. Employment Data

Employment reports—such as the U.S. Nonfarm Payrolls—are leading indicators of economic momentum. Rising employment boosts consumer spending and corporate earnings, benefiting equities. Conversely, higher unemployment often signals economic contraction and may prompt a defensive investment stance (Blanchard, 2021).

🏦 4. Central Bank Policies

Decisions by central banks (e.g., the Federal Reserve) on interest rates and liquidity injection significantly influence asset prices. Low-interest environments often support riskier asset classes like equities and real estate, while tightening cycles may favor fixed income or cash equivalents (Bernanke, 2013).

🛒 5. Consumer Confidence and Spending

Consumer sentiment indices reflect household optimism or pessimism. High consumer confidence can trigger spending booms, particularly in consumer discretionary sectors, while low confidence can lead to economic contraction (Case, Quigley, & Shiller, 2013).

🧠 Integrating Macroeconomic Analysis into Portfolio Allocation

Implementing a macro-driven strategy involves the following steps:

- 🔮 Economic Forecasting – Use macroeconomic models to predict future growth, inflation, and monetary policy.

- 📊 Asset Class Selection – Allocate to asset classes that benefit from forecasted macro trends.

- 🌐 Geographic Diversification – Hedge country-specific risks by diversifying globally.

- ⚖️ Risk Management – Utilize derivatives, cash allocation, or tactical shifts to manage volatility.

📉 Case Study: The 2008 Financial Crisis

Leading up to the 2008 crisis, macro indicators—like the housing price index, subprime mortgage growth, and credit default spreads—warned of systemic risk. Investors who recognized these red flags and reduced exposure to housing and financials preserved more capital than those who didn’t (Acharya & Richardson, 2009).

🧾 Conclusion

Macro-driven investing equips investors with a framework to understand and act on broad economic trends. By monitoring indicators like GDP, inflation, employment, and central bank policy, investors can proactively adjust portfolios to align with evolving economic realities. This top-down approach complements other strategies and is especially useful in uncertain environments.

Read More: https://wealthfitlife.com/how-to-build-a-multi-factor-model-for-equity-selection/

❓ FAQs

- What is macro-driven investing?

- Investing based on global economic indicators rather than individual stocks.

- How does GDP affect asset allocation?

- Higher GDP growth favors equities; lower GDP may push investors toward bonds.

- What should investors do during inflation?

- Allocate to inflation-resistant assets like commodities or TIPS.

- Why are central bank policies important for investors?

- They directly influence interest rates, liquidity, and market sentiment.

- Is macro investing suitable for retail investors?

- Yes, especially through ETFs and macroeconomic-themed funds.

- Can macro indicators predict market crashes?

- They can offer early warnings, though not exact timing.

- How frequently should macro indicators be reviewed?

- Monthly and quarterly, aligned with economic report releases.

- Does macro investing work in all market environments?

- It performs best in volatile or transitional economies.

- What tools assist macro investors?

- Bloomberg Terminal, Federal Reserve data, IMF and World Bank reports.

- Can macro investing reduce risk?

- Yes, by anticipating shifts and reallocating early.

📚 Academic References

- Acharya, V. V., & Richardson, M. (2009). Restoring Financial Stability: How to Repair a Failed System. John Wiley & Sons.

- Bernanke, B. S. (2013). The Federal Reserve and the Financial Crisis. Princeton University Press.

- Blanchard, O. (2021). Macroeconomics (8th ed.). Pearson.

- Case, K. E., Quigley, J. M., & Shiller, R. J. (2013). Wealth effects revisited 1975–2012. Critical Finance Review, 2(1), 101–128.

- Friedman, M., & Laibson, D. (2021). Foundations of Economic Analysis. Harvard University Press.

- Ilmanen, A. (2011). Expected Returns: An Investor’s Guide to Market Forecasting. Wiley Finance.

- Mankiw, N. G. (2019). Principles of Economics (8th ed.). Cengage Learning.

- Mishkin, F. S. (2018). The Economics of Money, Banking and Financial Markets (12th ed.). Pearson.