📊 How to Build a Multi-Factor Model for Equity Selection

In the world of investing, selecting the right equities is crucial for building a successful portfolio. One advanced method to enhance stock selection is by constructing a multi-factor model. This approach goes beyond traditional single-factor models by incorporating multiple variables that can influence a stock’s performance. In this article, we’ll delve into the steps of building a multi-factor model for equity selection, discuss the factors to consider, and provide insights into practical implementation.

🔍 What Is a Multi-Factor Model?

A multi-factor model is a financial model that uses multiple factors to explain the returns of a security or a portfolio. Unlike single-factor models like the Capital Asset Pricing Model (CAPM), which considers only the market risk factor, multi-factor models incorporate various other factors that might affect asset returns. These factors can be macroeconomic, fundamental, or statistical in nature.

Types of Multi-Factor Models

- Macroeconomic Factor Models: These models use economic variables such as interest rates, inflation, and GDP growth to explain asset returns.

- Fundamental Factor Models: These models consider company-specific factors like earnings growth, debt levels, and valuation metrics.

- Statistical Factor Models: These models use statistical techniques to identify factors that explain the co-movement of asset returns.

🧩 Key Factors in Equity Selection

When building a multi-factor model for equity selection, it’s essential to choose factors that have a proven relationship with stock returns. Some commonly used factors include:

- Value: Stocks that are undervalued relative to their fundamentals (e.g., low price-to-earnings ratio).

- Momentum: Stocks that have shown an upward price trend over a certain period.

- Size: The market capitalization of a company; smaller companies often outperform larger ones.

- Quality: Companies with strong profitability, stable earnings, and low debt levels.

- Volatility: Stocks with lower price volatility may offer safer investment options.

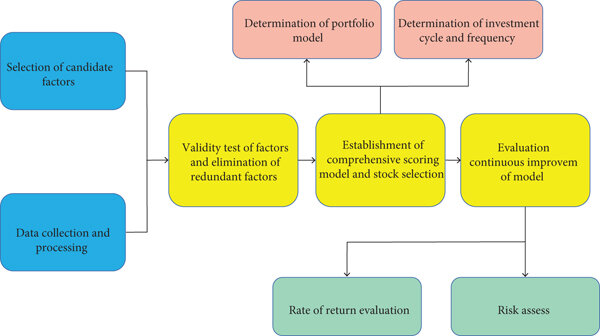

🛠 Steps to Build a Multi-Factor Model

1. Data Collection

Gather historical data on the chosen factors for a broad universe of stocks. This data can be sourced from financial databases like Bloomberg, Reuters, or Yahoo Finance.

2. Factor Construction

For each stock, calculate the values for each selected factor. For example, to measure value, compute the price-to-earnings ratio for each stock.

3. Normalization

Standardize the factor values to ensure comparability. This can involve scaling the factors to have a mean of zero and a standard deviation of one.

4. Factor Scoring

Assign scores to each stock based on its factor values. Stocks with higher scores on desirable factors are considered more attractive.

5. Portfolio Construction

Combine the factor scores to rank stocks and select the top performers for inclusion in the portfolio. This can be done using equal weighting or optimization techniques.

6. Backtesting

Test the performance of the constructed portfolio using historical data to evaluate its effectiveness.

📈 Implementing the Model

Once the model is built, it’s time to implement it in real-world investing. This involves:

- Rebalancing: Regularly update the portfolio to reflect changes in factor scores.

- Monitoring: Continuously track the performance of the portfolio and individual stocks.

- Adjusting: Modify the model as necessary based on performance and changing market conditions.

🧠 Advanced Considerations

- Factor Correlation: Be aware of correlations between factors. Highly correlated factors can lead to overfitting and reduced diversification.

- Data Quality: Ensure the accuracy and reliability of the data used in the model.

- Market Conditions: Recognize that the effectiveness of certain factors may vary under different market conditions.

✅ Conclusion

Building a multi-factor model for equity selection allows investors to make more informed decisions by considering a broader range of variables. By carefully selecting and combining factors, and regularly updating the model, investors can enhance their chances of achieving superior returns.

Read More: https://wealthfitlife.com/quantitative-vs-qualitative-investment-analysis-when-and-how-to-use-each/

❓ Frequently Asked Questions

- What is a multi-factor model?

- A multi-factor model is a financial model that uses multiple factors to explain the returns of a security or a portfolio.

- Why use a multi-factor model?

- It provides a more comprehensive view of the factors influencing asset returns, leading to better-informed investment decisions.

- What factors are commonly used in equity selection?

- Common factors include value, momentum, size, quality, and volatility.

- How do I collect data for the model?

- Data can be sourced from financial databases like Bloomberg, Reuters, or Yahoo Finance.

- What is factor scoring?

- Factor scoring involves assigning scores to each stock based on its factor values to rank them accordingly.

- How often should I rebalance the portfolio?

- Rebalancing frequency depends on the investment strategy but is typically done quarterly or annually.

- Can the model be used for individual stocks?

- Yes, the model can be applied to individual stocks as well as portfolios.

- What is backtesting?

- Backtesting involves testing the performance of the constructed portfolio using historical data to evaluate its effectiveness.

- How do I handle factor correlation?

- Be aware of correlations between factors and adjust the model to avoid overfitting and reduced diversification.

- Can the model be adjusted for different market conditions?

- Yes, the model can be modified as necessary based on performance and changing market conditions.

By following these steps and considerations, investors can construct a robust multi-factor model tailored to their equity selection needs.