🧠Introduction

In the dynamic world of investing, emotions often play a pivotal role in shaping decisions. One such emotion that has gained prominence in recent years is the Fear of Missing Out, commonly known as FOMO. This psychological phenomenon has significantly influenced investor behavior, especially in the age of social media and rapid information dissemination. Understanding the psychology behind FOMO and its impact on investment decisions is crucial for both novice and seasoned investors.

💡Understanding FOMO in the Investment Context

FOMO refers to the anxiety or apprehension that one might miss out on a potentially rewarding opportunity, leading individuals to make impulsive decisions. In the realm of investing, FOMO manifests when investors, driven by the fear of missing out on lucrative returns, make hasty investment choices without thorough analysis or consideration of risks.

📊The Role of Social Media

The advent of social media platforms has amplified FOMO in investing. Real-time updates, viral trends, and peer discussions can create a sense of urgency and excitement, prompting individuals to invest hastily. Platforms like Reddit’s r/WallStreetBets and Twitter have become hubs for discussing trending stocks, often leading to herd behavior where investors follow the crowd without conducting proper due diligence.

💭The Psychological Mechanisms Behind FOMO

Several psychological principles underpin FOMO-driven investment decisions:

- Herd Mentality: Individuals tend to mimic the actions of a larger group, especially during uncertain times. This can lead to collective irrational behavior, such as investing in overhyped stocks without assessing their true value.

- Loss Aversion: The fear of losing out on potential gains can be more compelling than the desire to achieve equivalent gains. This bias can lead investors to take excessive risks to avoid perceived losses.

- Overconfidence Bias: Investors may overestimate their knowledge or ability to predict market movements, leading them to make bold investment decisions based on incomplete information.

To know more refer to: https://www.youtube.com/watch?v=bD3KKeHQhJY

💸The Impact of FOMO on Investment Decisions

FOMO can have several detrimental effects on investment strategies:

- Impulsive Investments: Driven by emotions rather than rational analysis, investors may purchase assets hastily, often leading to suboptimal returns.

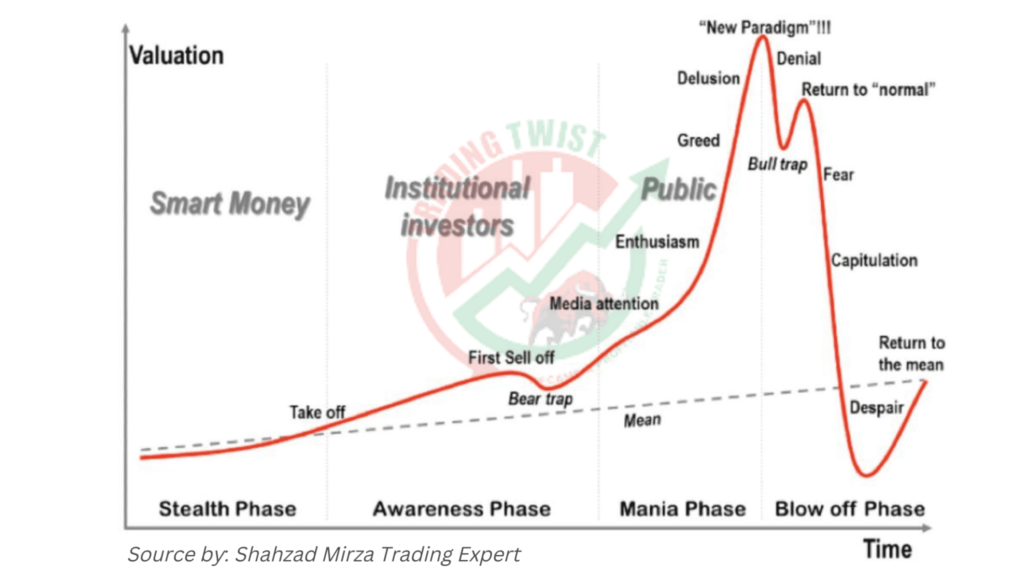

- Increased Volatility: Herd behavior can inflate asset prices beyond their intrinsic value, creating bubbles that may eventually burst.

- Neglect of Long-Term Goals: The excitement of short-term gains can divert attention from long-term investment objectives, leading to a misalignment of strategies.

📈Case Studies: FOMO in Action

💥1. The GameStop Saga

In early 2021, GameStop’s stock price soared due to a coordinated effort by retail investors on Reddit. Many investors, fearing they would miss out on potential gains, purchased shares without understanding the underlying fundamentals, leading to significant volatility and financial losses for some.

🛡️2. Cryptocurrency Craze

The rapid rise of cryptocurrencies like Bitcoin and Dogecoin has been fueled by FOMO. Investors, driven by the fear of missing out on substantial profits, have invested heavily without fully understanding the risks involved, leading to market fluctuations and regulatory scrutiny.

🎯Strategies to Mitigate FOMO in Investing

To combat the negative effects of FOMO, investors can adopt the following strategies:

- Develop a Clear Investment Plan: Establishing a well-defined investment strategy based on individual financial goals and risk tolerance can provide a framework for making informed decisions.

- Conduct Thorough Research: Before making investment choices, it’s essential to analyze the fundamentals of potential investments and consider their long-term viability.

- Limit Exposure to Social Media Influences: While social media can provide valuable information, it’s crucial to critically evaluate the content and avoid making decisions solely based on trending topics.

- Practice Patience and Discipline: Maintaining a long-term perspective and resisting the urge to chase short-term gains can help in making more rational investment decisions.

🔑Conclusion

FOMO is a powerful psychological force that can significantly influence investment decisions. While it may drive individuals to seize opportunities, it can also lead to impulsive choices and financial setbacks. By understanding the psychological mechanisms behind FOMO and implementing strategies to mitigate its effects, investors can make more informed and rational decisions, aligning their investments with their long-term financial goals.

Read more: https://wealthfitlife.com/the-5-most-common-investment-mistakes-and-how-to-avoid-them/

❓Frequently Asked Questions (FAQs)

- What is FOMO in investing?

- FOMO in investing refers to the fear of missing out on profitable opportunities, leading individuals to make impulsive investment decisions.

- How does social media contribute to FOMO?

- Social media platforms provide real-time updates and discussions, creating a sense of urgency and prompting individuals to invest hastily.

- What are the psychological biases associated with FOMO?

- Psychological biases include herd mentality, loss aversion, and overconfidence bias, all of which can influence investment decisions.

- Can FOMO lead to financial losses?

- Yes, impulsive investment decisions driven by FOMO can result in purchasing overvalued assets, leading to potential financial losses.

- How can investors avoid FOMO?

- Investors can avoid FOMO by developing a clear investment plan, conducting thorough research, and limiting exposure to social media influences.

- Is FOMO more prevalent among younger investors?

- Research indicates that younger investors, particularly those aged 18-40, are more susceptible to FOMO due to increased social media usage and impulsive decision-making tendencies.

- What role does loss aversion play in FOMO?

- Loss aversion refers to the tendency to fear losses more than equivalent gains, which can drive investors to make hasty decisions to avoid perceived losses.

- How does herd mentality affect investment behavior?

- Herd mentality leads individuals to mimic the actions of a larger group, often resulting in irrational investment decisions during uncertain times.

- Can FOMO lead to market bubbles?

- Yes, collective irrational behavior driven by FOMO can inflate asset prices beyond their intrinsic value, creating bubbles that may eventually burst.

- What are some examples of FOMO-driven investments?

- Examples include the GameStop stock surge and the cryptocurrency boom, where investors made decisions based on hype rather than fundamentals.

💬Academic References

- Statman, M. (2019). Behavioral Finance: The Second Generation. CFA Institute Research Foundation.

- Hoffman, A., et al. (2020). The impact of social media on investment behavior. Journal of Behavioral Finance, 21(3), 233-245.

- Carrick, A. (2021). ‘Emotional investors’ make impulsive bets due to ‘FOMO’ and social media hype. This is Money. Available at: https://www.thisismoney.co.uk/money/investing/article-10309099/Investors-make-impulsive-bets-FOMO-social-media-hype.html