Game Theory and Strategic Investing in Competitive Markets

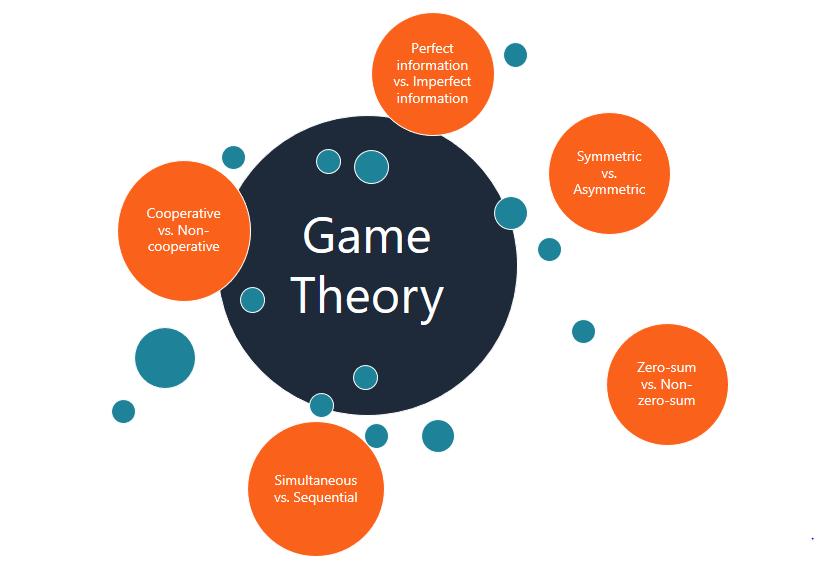

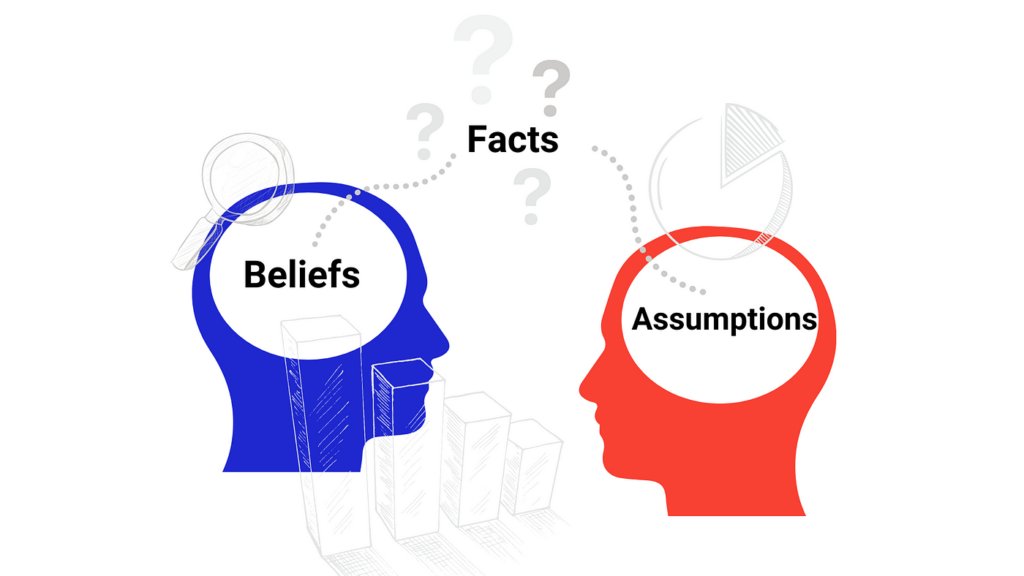

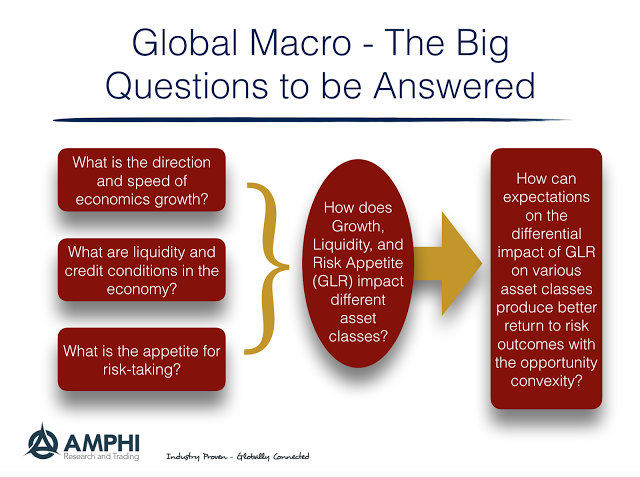

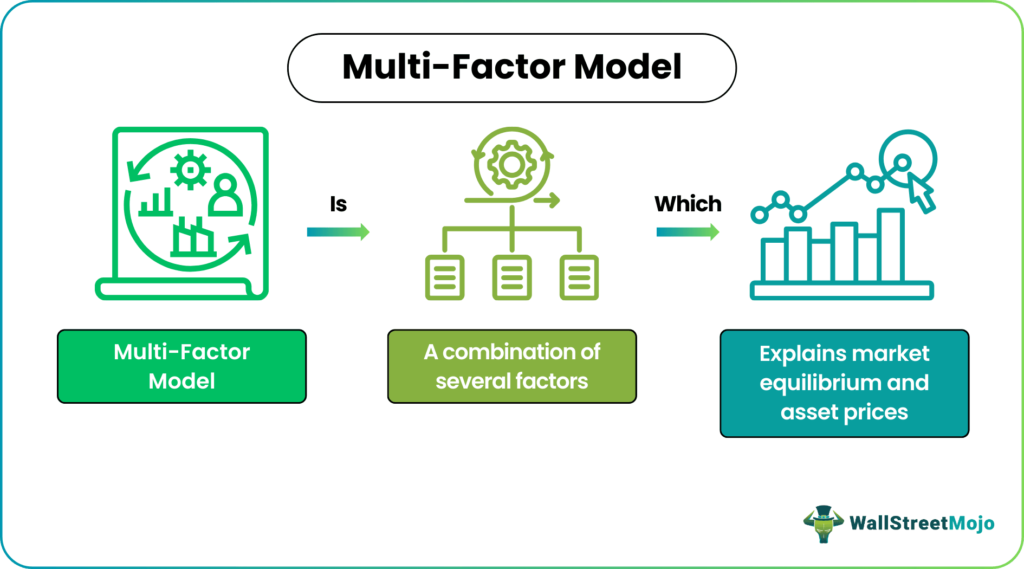

. 🎮 Game Theory and Strategic Investing in Competitive Markets 🧠 Introduction In today’s highly competitive and rapidly evolving markets, investors need more than just financial statements and market trends to make strategic decisions. They require a deeper understanding of how businesses interact with each other, respond to market signals, and adapt to competitive pressures. […]

Game Theory and Strategic Investing in Competitive Markets Read More »