SIP vs. Lumpsum Investment: What Should You Choose and Why?

💰 Want to Invest But Confused Between SIP and Lumpsum? You’re Not Alone!

If you’re in your 20s or early 30s, chances are you’ve just started earning, saving, or thinking seriously about your financial future. That’s awesome! But with so much financial jargon out there, making the right investment decision can feel overwhelming.

One of the most common questions young Indian investors ask is:

“Should I go for SIP or Lumpsum investment?”

Well, let’s break it down in a simple, no-nonsense way so you can make the smartest move for your goals.

🧩 What is SIP?

SIP stands for Systematic Investment Plan. It’s like putting your money on auto-pilot. You invest a fixed amount (say ₹500 or ₹1000) every month into a mutual fund.

✅ Best for:

- Beginners

- People with regular income (like salaried professionals)

- Anyone who wants to build a habit of investing

🧠 Why SIP is Smart:

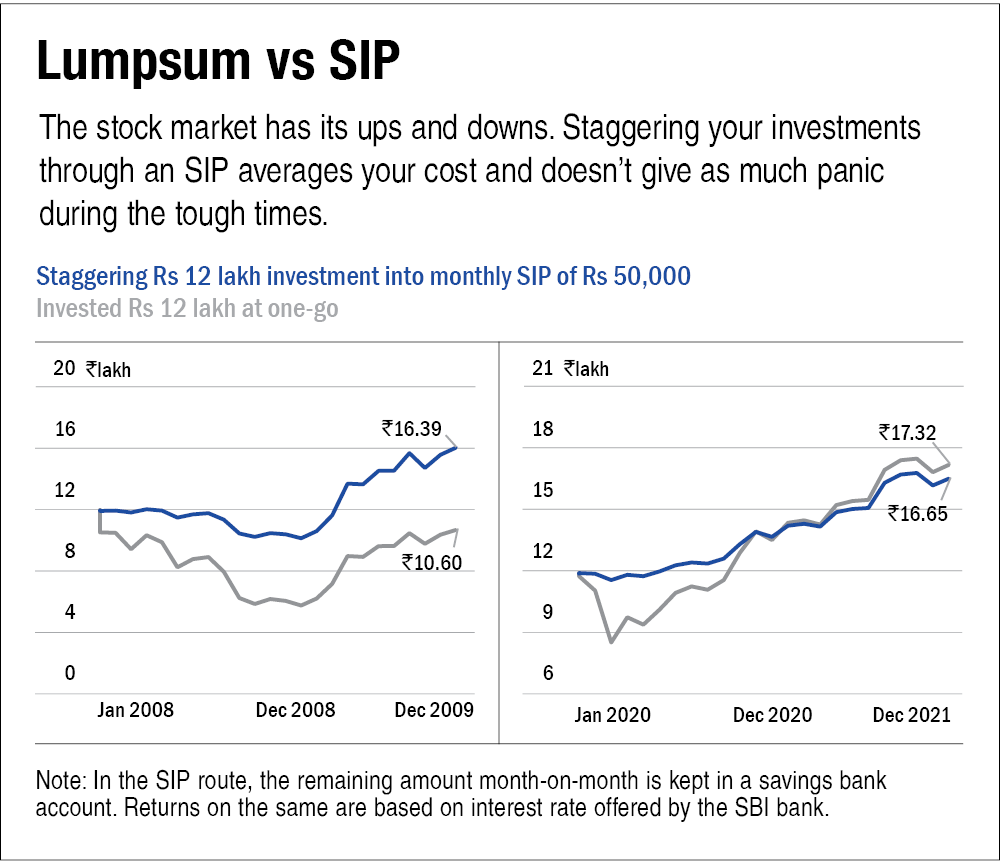

- Rupee Cost Averaging: You buy more when the market is down and less when it’s up. This reduces your average cost.

- Discipline: You don’t need to “time” the market.

- Easy on the Pocket: You don’t need lakhs to get started.

🏦 What is Lumpsum Investment?

Lumpsum investment means investing a big amount (say ₹50,000 or ₹2 lakh) all at once in a mutual fund or stock.

✅ Best for:

- People with a large bonus or savings

- Those who can handle short-term ups and downs

- Confident investors with market knowledge

🧠 Why Lumpsum Can Work:

- Faster Compounding: More money invested early = more growth.

- Market Timing Advantage (if you enter at the right time)

- Good for Long-Term Goals (like a house, marriage, or starting a business)

🥊 SIP vs. Lumpsum: Head-to-Head

| Feature | SIP | Lumpsum |

|---|---|---|

| Investment Style | Monthly, disciplined | One-time, bold move |

| Ideal For | Beginners, salaried folks | Investors with big savings |

| Risk Factor | Lower (averaged out) | Higher (depends on market) |

| Flexibility | High (you can pause/stop) | Medium (money locked) |

| Returns (long-term) | Steady and balanced | Can be higher, or riskier |

🎯 So, What Should YOU Choose?

Ask yourself 3 quick questions:

- Do I have a stable monthly income?

→ Go for SIP. Start small and grow. - Did I just get a bonus, gift, or inheritance?

→ Lumpsum could be the right move. - Am I new to investing and afraid of market swings?

→ SIP will keep you stress-free and consistent.

💡 Pro Tip: You don’t have to pick just one. Many smart investors do both — SIP for discipline, Lumpsum for opportunities.

🧠 Real Talk for 20–30-Year-Olds

You’re young. Time is on your side. Even if you start with ₹500 a month via SIP, you’re already ahead of most people.

Instead of overthinking, just start. The earlier you begin, the bigger your wealth will grow thanks to compounding.

🚀 “The best time to invest was yesterday. The next best time is today.”

✅ Conclusion

Both SIP and Lumpsum investments have their strengths. Your decision should depend on your income, risk appetite, and financial goals. Don’t wait for the “perfect” time — in investing, consistency always beats perfection.

Read More:https://wealthfitlife.com/10-warren-buffett-tips-for-indian-investors/

📌 Top 10 FAQs: SIP vs. Lumpsum

- Can I start a SIP with just ₹500/month?

Yes! Most mutual funds allow SIPs starting from ₹500. - Is Lumpsum riskier than SIP?

Usually yes, especially if the market is at a high point when you invest. - Which gives better returns – SIP or Lumpsum?

Over the long term, both can give great returns. It depends on timing and market conditions. - Can I invest both via SIP and Lumpsum?

Absolutely. In fact, it’s a smart strategy. - What if I miss an SIP installment?

No problem. It’ll just be skipped for that month. - Is SIP better for tax saving?

Only if you invest in ELSS mutual funds (Equity Linked Savings Scheme). - How long should I run an SIP?

Ideally 5 years or more. Longer = better compounding. - What happens if I withdraw my Lumpsum early?

You may have to pay exit loads or short-term capital gains tax. - When is the best time to invest a Lumpsum?

Ideally when the market is down or during corrections. - Is SIP safe?

No investment is 100% safe, but SIP spreads your risk over time.

📚 Academic & Credible References

- Bhargava, V., & Malik, V. (2020). Comparative Study of SIP and Lumpsum Investment in Indian Mutual Funds. International Journal of Financial Studies.

- NSE India. (2023). Investor Education – Mutual Funds & SIPs. www.nseindia.com

- AMFI India. (2024). Systematic Investment Plan – Benefits and Guide. www.amfiindia.com

- Reserve Bank of India (RBI). (2024). Handbook of Statistics on the Indian Economy.

- Value Research Online (2025). SIP Returns Calculator and Fund Analysis Tools.