.

🎮 Game Theory and Strategic Investing in Competitive Markets

🧠 Introduction

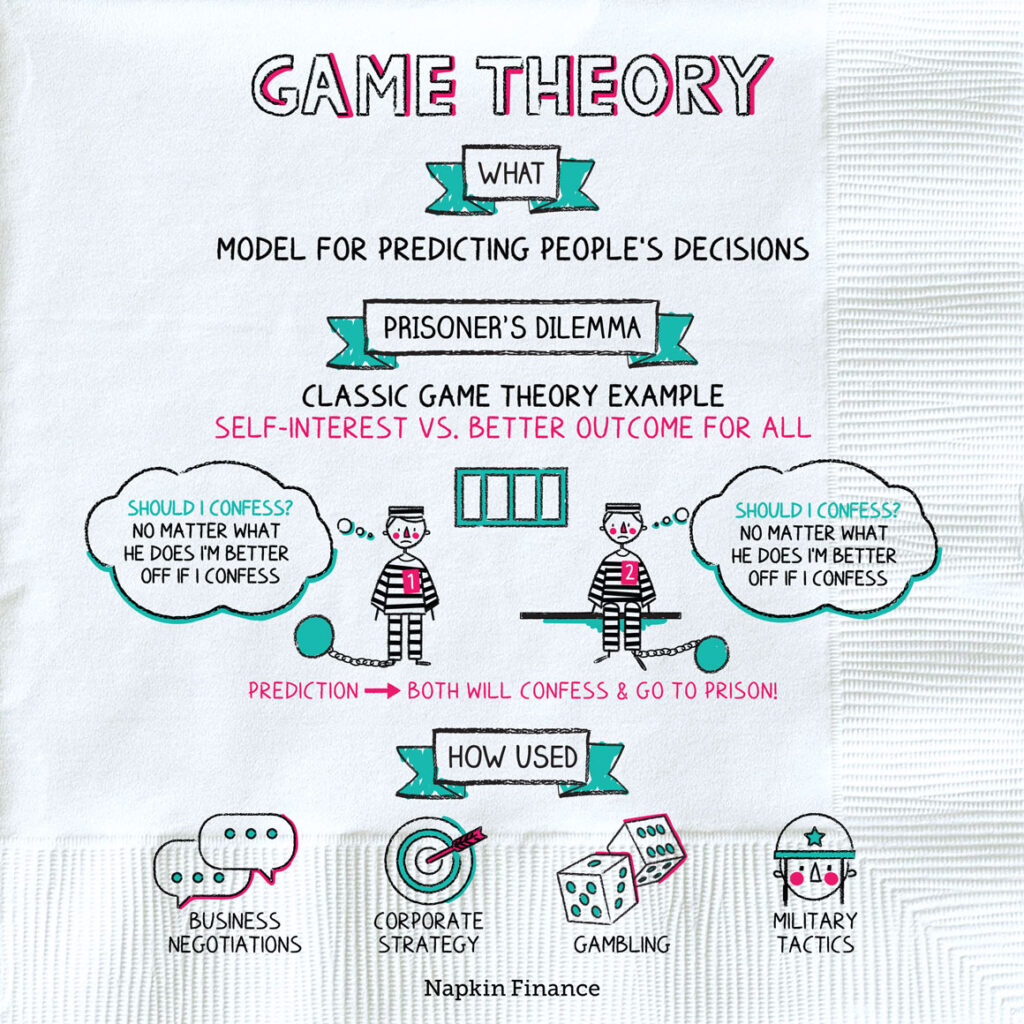

In today’s highly competitive and rapidly evolving markets, investors need more than just financial statements and market trends to make strategic decisions. They require a deeper understanding of how businesses interact with each other, respond to market signals, and adapt to competitive pressures. This is where Game Theory plays a critical role.

Game Theory, first formalized by John von Neumann and Oskar Morgenstern in 1944 in their groundbreaking book Theory of Games and Economic Behavior, is a mathematical framework for analyzing situations where the outcomes depend not only on your actions but also on the actions of others (Von Neumann & Morgenstern, 1944). In investment terms, this means understanding how companies behave in strategic environments and how those behaviors affect investment outcomes.

Whether assessing mergers and acquisitions, pricing wars, regulatory decisions, or competitive positioning, investors can use game theory to uncover hidden risks and opportunities. By modeling business interactions as “games,” investors gain insight into equilibrium strategies, potential reactions, and optimal moves.

🎯 Core Concepts in Game Theory

🧩 1. Nash Equilibrium

Nash Equilibrium, named after Nobel laureate John Nash, is a state in a strategic game where no player can benefit by changing strategies while the others keep theirs unchanged. It represents strategic stability and is crucial in competitive markets where firms react to each other’s decisions.

In investing, recognizing equilibrium points can help identify industries or companies in a stable strategic situation. This insight helps avoid industries mired in destructive competition or ones where small shifts can create massive upheaval (Nash, 1951).

🔗 2. The Prisoner’s Dilemma

The classic Prisoner’s Dilemma illustrates how rational actors may choose suboptimal outcomes due to a lack of trust. Two firms might undercut each other’s prices to gain market share, even if both would benefit from cooperation or maintaining higher prices.

This dilemma is commonly seen in price wars in the airline, telecommunications, or retail industries—understanding it helps investors evaluate how sustainable a firm’s pricing power is (Dixit & Nalebuff, 1991).

🧮 3. Cournot and Bertrand Models

- The Cournot model analyzes quantity-based competition where each firm decides how much output to produce, assuming rivals’ output is fixed.

- The Bertrand model, on the other hand, examines price-based competition assuming firms produce identical goods and choose prices simultaneously.

Investors can use these models to predict how price or output decisions affect profitability in oligopolistic markets like steel, oil, or automobiles (Tirole, 1988).

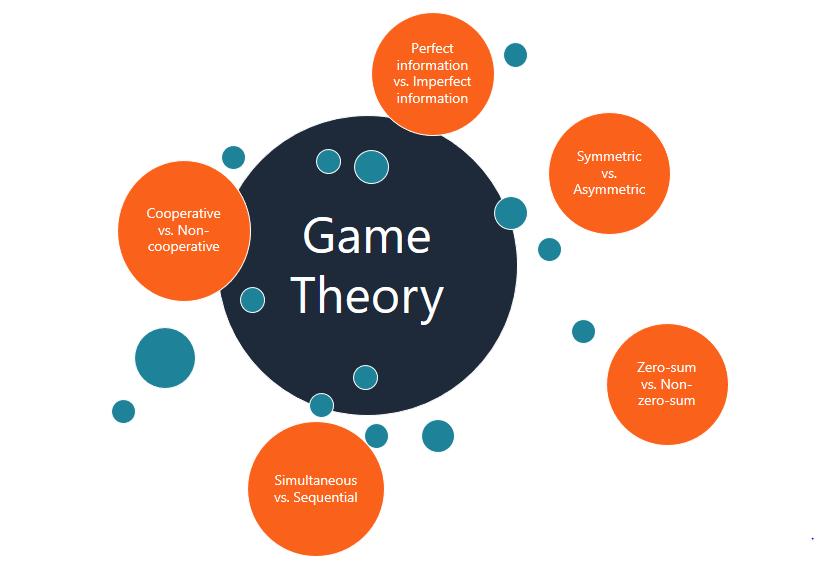

⚖️ 4. Zero-Sum vs. Non-Zero-Sum Games

- A zero-sum game implies one player’s gain is another’s loss.

- A non-zero-sum game allows mutual gains, often through cooperation or innovation.

Strategic alliances, joint ventures, or patent-sharing often fall into non-zero-sum games, which can lead to long-term value creation. Investors should watch for such dynamics to invest in collaborative or innovating firms.

🧠 5. Dominant Strategies

A dominant strategy is one that yields the highest payoff for a player, no matter what the other players do. In markets, companies with dominant strategies tend to outperform consistently due to unique advantages—strong IP, cost leadership, or network effects.

📈 Strategic Investing Using Game Theory

🔮 1. Anticipating Competitor Moves

By modeling competitors as rational players with specific objectives, investors can estimate likely responses to strategic initiatives like product launches, pricing changes, or capacity expansions. This predictive capability improves investment timing and reduces downside risks.

Example: An investor in a retail chain might anticipate an aggressive pricing response from Amazon and adjust exposure accordingly.

🔄 2. Identifying Market Equilibria

In mature industries, strategies tend to stabilize over time. Recognizing equilibrium points can guide investors to firms well-adapted to their competitive environments. For instance, oligopolies like Coca-Cola and Pepsi often maintain a pricing and advertising equilibrium.

🌪️ 3. Managing Volatility and Risk

Game theory helps investors model “what-if” scenarios, especially under uncertainty. In volatile sectors like energy or technology, even small strategic shifts can ripple across markets. Understanding these interdependencies aids in building diversified, risk-aware portfolios.

📊 4. Strategic Signaling

Companies often send signals to influence competitors’ perceptions. Price cuts, dividend increases, or public statements can act as signals in a game-theoretic framework. Investors who decode these signals correctly can position portfolios ahead of market shifts.

Example: A high R&D spend by Apple might signal innovation investment, which could deter smaller competitors and boost long-term stock prospects.

🏢 Applications in Real-World Competitive Markets

🧱 1. Oligopolistic Markets

In sectors with few dominant players, like wireless telecom or airlines, strategic moves are interdependent. Price changes, new entrants, or regulatory shifts can trigger chain reactions. Game theory helps model this behavior to determine who might gain or lose in a given scenario.

Example: In the airline industry, a fare reduction by one major player is often followed by others, compressing margins—a dynamic well-captured in Bertrand competition.

🤝 2. Mergers and Acquisitions

Game theory is integral in M&A strategies. Firms use it to anticipate rivals’ responses, such as counter-bids or market retaliation. Investors assess whether an acquisition will lead to synergies or provoke aggressive competitor moves that dilute its value.

🧾 3. Regulatory Response and Compliance

Game theory aids in analyzing how firms adapt to government regulations, such as carbon taxes or antitrust rules. Investors can predict which firms are better equipped to handle regulatory costs or benefit from new rules that hurt weaker competitors.

🛡️ 4. Defensive Strategies

Firms often engage in “entry deterrence” strategies like excess capacity building or temporary price cuts to signal their strength. Investors can read these moves as signs of market power, which often translates to long-term value protection.

🔚 Conclusion

Game theory is not just an abstract concept for economists; it is a practical and powerful tool for strategic investing. By modeling the interactions between firms, regulators, consumers, and other stakeholders, game theory enables investors to:

- Predict competitor behavior

- Recognize market stability or instability

- Identify firms with strategic advantages

- Assess the impact of M&A and regulatory changes

As markets grow more interconnected, strategic thinking becomes essential. Investors who incorporate game-theoretic reasoning are better equipped to make decisions in complex, dynamic environments.

Read more:https://wealthfitlife.com/commodities-as-an-inflation-hedge-myths-vs-data-backed-reality/

❓ Frequently Asked Questions (FAQs)

1. What is the basic idea behind game theory?

Game theory analyzes how rational players make decisions in situations where outcomes depend on the choices of others. It uses models and mathematical logic to determine optimal strategies.

2. How is game theory used in financial markets?

It helps investors understand how companies in competitive markets respond to one another, allowing for better timing and positioning in stocks, bonds, or sectors.

3. What is an example of a Nash Equilibrium in business?

When two large airlines set similar ticket prices and maintain market share without undercutting each other, they are in a Nash Equilibrium.

4. Can game theory predict stock prices?

Not directly. But it helps investors understand strategic behavior that may affect pricing, such as responses to mergers, competition, or regulations.

5. What’s the difference between Cournot and Bertrand models?

Cournot focuses on quantity competition (how much to produce), while Bertrand focuses on price competition. The outcomes are different: Bertrand leads to lower prices in many cases.

6. Is game theory only useful for large investors or hedge funds?

No. Even individual investors can apply its principles to evaluate competitive positioning or predict strategic outcomes.

7. How does game theory deal with uncertainty?

It models different scenarios with probabilities and strategies for each player, helping to visualize outcomes and associated risks.

8. What is a dominant strategy, and why is it important?

A dominant strategy yields the best payoff regardless of what others do. Firms with dominant strategies often have competitive advantages and better investment prospects.

9. How can game theory improve risk management?

By modeling competitor responses and market dynamics, investors can foresee adverse outcomes and hedge or diversify accordingly.

10. Where can I learn more about game theory and investing?

Recommended readings include:

- Thinking Strategically by Dixit and Nalebuff

- The Art of Strategy by Avinash Dixit and Barry Nalebuff

- Academic journals like The Journal of Financial Economics and Games and Economic Behavior

📚 Academic References

- Von Neumann, J., & Morgenstern, O. (1944). Theory of Games and Economic Behavior. Princeton University Press.

- Nash, J. (1951). “Non-Cooperative Games.” Annals of Mathematics, 54(2), 286-295.

- Tirole, J. (1988). The Theory of Industrial Organization. MIT Press.

- Dixit, A., & Nalebuff, B. (1991). Thinking Strategically: The Competitive Edge in Business, Politics, and Everyday Life. Norton.

- Brandenburger, A., & Nalebuff, B. (1996). Co-opetition. Currency