🕰️Why Time in the Market Beats Timing the Market – Real-Life Scenarios, Stories, and Academic Insight

In the realm of investing, the phrase “time in the market beats timing the market” has become almost cliché. Yet, it remains one of the most fundamental truths of long-term wealth building. The allure of making a quick profit by buying low and selling high often tempts investors to try and “time” their trades. However, history, economic theory, and real-world data repeatedly show that staying invested in the market—no matter the ups and downs—delivers more consistent, reliable returns over time.

This article dives deep into why long-term investment triumphs over market timing, supported by real-life stories, academic research, and compelling examples to help illustrate the concept.

🔍What Is Market Timing vs. Time in the Market?

Let’s begin with a clear distinction:

- Market Timing: This strategy involves trying to predict future market movements. Investors attempt to buy just before prices rise and sell just before they fall.

- Time in the Market: This strategy emphasizes staying invested over a long period, regardless of short-term market fluctuations.

While market timing might sound smart in theory, in practice it’s like catching lightning in a bottle—possible, but incredibly rare.

📖Storytelling from the Markets: Real-Life Lessons

👨💼1. John vs. Jane: A Tale of Two Investors

Let’s imagine two investors—John and Jane.

- John, believing he can predict market moves, watches financial news religiously. In 2008, spooked by the financial crisis, he pulled all his investments out of the market. He sat on cash, waiting for “the right time” to re-enter. He missed the bull market that followed and only got back in during 2013—after most gains had already been realized.

- Jane, on the other hand, took a different route. She invested in a low-cost S&P 500 index fund and kept contributing regularly, even during downturns. By 2023, Jane’s portfolio was worth nearly double John’s, despite him entering the market earlier.

The difference? Time in the market and the power of compound growth.

📉2. The Great Recession: 2008 Financial Crisis

During the 2008 recession, the S&P 500 dropped nearly 57% from its October 2007 high to its March 2009 bottom. Panic was widespread. Many investors pulled out, locking in their losses.

However, those who stayed invested or even bought more during the downturn experienced a phenomenal recovery. By 2013, the S&P 500 had fully rebounded. A $10,000 investment at the 2009 bottom would have more than tripled by 2020 (Morningstar, 2023).

🧠The Psychology of Market Timing

Trying to time the market isn’t just financially risky—it’s psychologically taxing. The human brain is wired to avoid loss more than to seek gain, a phenomenon known as loss aversion (Kahneman & Tversky, 1979).

Investors tend to overreact during downturns and become overconfident in bull markets, leading to poor decisions. Behavioral finance studies have shown that the average investor significantly underperforms the market due to such errors (Dalbar Inc., 2021).

🎓The Academic Perspective

Numerous academic studies back the claim that staying invested works better:

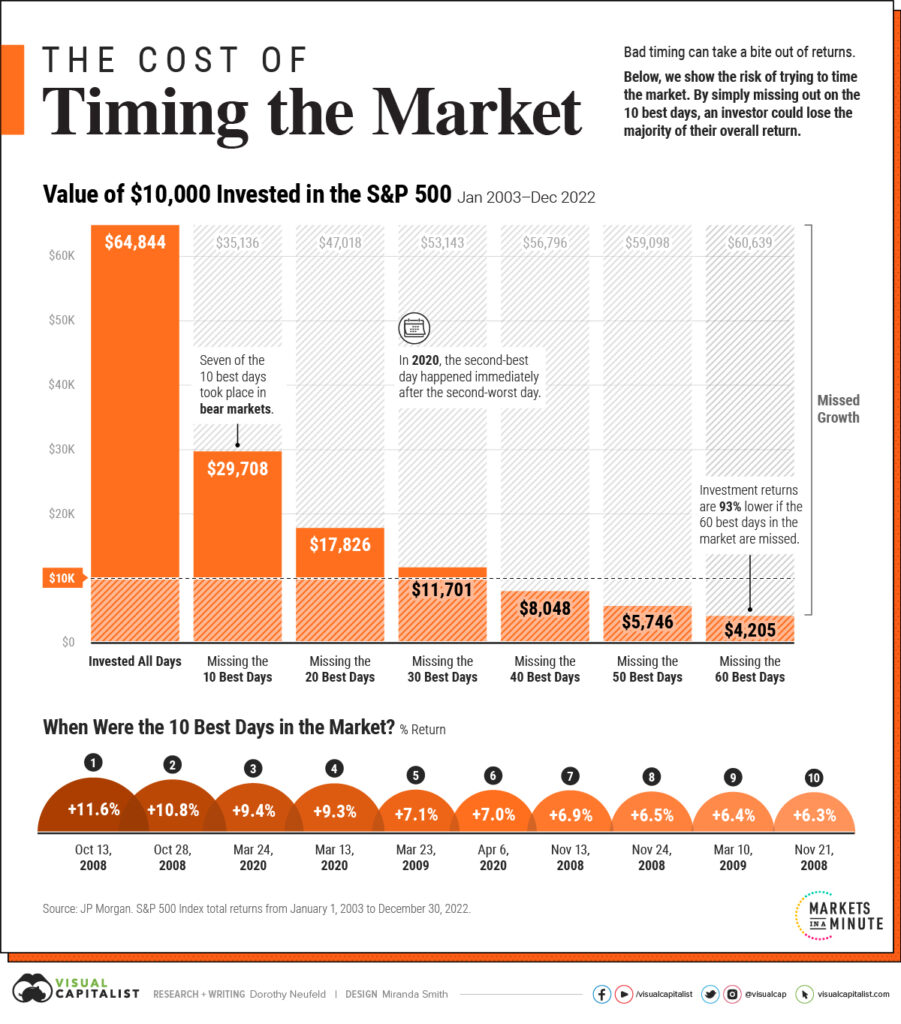

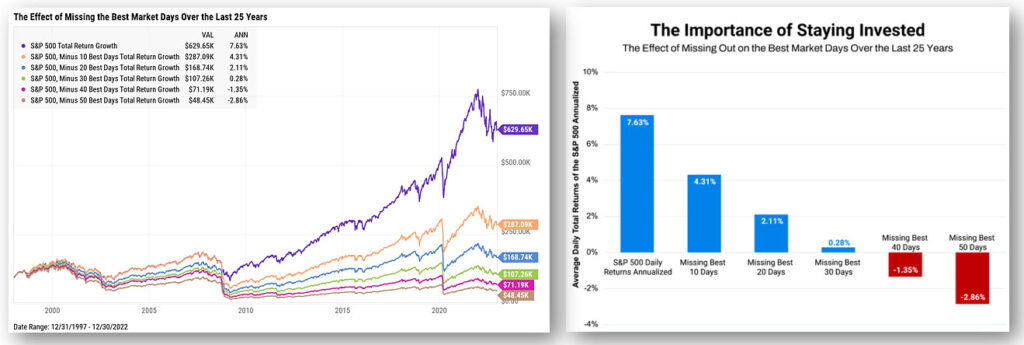

- Dalbar’s Quantitative Analysis of Investor Behavior found that the average equity fund investor earned 6.81% annually from 1991 to 2020, while the S&P 500 returned 10.23% annually over the same period. The difference was due largely to poor timing decisions (Dalbar, 2021).

- Sharpe (1975) demonstrated that for a market timer to outperform a passive investment, they must be right at least 74% of the time, an accuracy rate that even professionals struggle to achieve.

- A Vanguard study found that missing just the 10 best days in the market over 20 years could cut total returns by nearly half (Vanguard, 2020).

💵The Power of Compounding

Compounding is often called the eighth wonder of the world for a reason. It’s simple but powerful: your investment earns returns, and those returns in turn earn returns.

Let’s say you invest $10,000 in an index fund earning an average of 8% per year:

- After 10 years: ~$21,600

- After 20 years: ~$46,600

- After 30 years: ~$100,600

This exponential growth is only possible with time—not perfectly timed trades.

To learn More Visit:https://www.youtube.com/shorts/bGOrtzmXQ-0

🧘Emotional Discipline: The Unsung Hero of Investing

Staying in the market requires emotional resilience. During every downturn—whether it’s the 2000 dot-com crash, the 2008 housing collapse, or the 2020 pandemic—investors are tested. Those who stay the course often end up ahead.

Jack Bogle, founder of Vanguard, famously said: “Time is your friend; impulse is your enemy.”

💸Lower Costs, Better Results

Market timing often leads to:

- More frequent trading

- Higher transaction fees

- Short-term capital gains taxes

On the other hand, long-term investing minimizes costs, maximizes tax efficiency, and simplifies decision-making.

🧾Conclusion: Trust the Process, Not the Prediction

The evidence is overwhelming: trying to time the market is a gamble. Staying invested, diversifying wisely, and allowing time to do the heavy lifting leads to better outcomes.

As Warren Buffett once put it: “The stock market is a device for transferring money from the impatient to the patient.”

Read More:https://wealthfitlife.com/ai-powered-portfolios-are-robo-advisors-the-future-of-wealth-building/

❓FAQs: Time in the Market vs. Timing the Market

1. What’s wrong with timing the market if I have good information?

Even the best analysts often get it wrong. Market movements are influenced by countless unpredictable factors, making accurate timing virtually impossible.

2. Is there ever a good time to sell?

Yes, when your financial goals change or you need to rebalance your portfolio—not based on market predictions.

3. How do I avoid emotional decisions when the market crashes?

Have a long-term plan and stick to it. Consider working with a financial advisor or using automated investing platforms that remove emotion from the process.

4. What are the biggest mistakes market timers make?

They often sell after a drop (locking in losses) and buy after a rise (chasing performance), leading to poor returns.

5. Can dollar-cost averaging help?

Yes! By investing a fixed amount regularly, you reduce the risk of investing a lump sum at the wrong time.

6. Should I ever hold cash waiting for a crash?

Timing a crash is just as hard as timing a rally. Staying invested and diversified is generally safer.

7. What about investing in individual stocks?

That adds another layer of risk and requires even more precise timing. Index funds offer broad market exposure and lower volatility.

8. How long should I stay invested?

Ideally, at least 5–10 years. The longer, the better, to benefit from compounding and market recoveries.

9. How can I tell if I’m a market timer?

If you’re frequently reacting to headlines or switching investments based on gut feeling, you’re likely trying to time the market.

10. Is now a good time to invest?

It’s always a good time to start investing—for the long term. Time in the market always trumps trying to guess the perfect entry point.Why Time in the Market Beats Timing the Market – Real-Life Scenarios, Stories, and Academic Insight