AI-Powered Portfolios 🤖💰: Are Robo-Advisors the Future of Wealth Building?

In today’s digital world, the way we manage money is rapidly evolving. The emergence of AI-powered robo-advisors has opened new doors for investors who seek a smart, efficient, and low-cost way to build wealth. But are these automated platforms the future of investing—or just a trend?

Let’s break down what robo-advisors are, how they work, and whether they’re shaping the next generation of personal finance.

What Are Robo-Advisors? 📊

Robo-advisors are automated investment platforms that use algorithms and artificial intelligence to manage portfolios with minimal human intervention. They assess your financial goals, risk tolerance, and time horizon to recommend personalized investment strategies.

These platforms typically offer:

- Portfolio rebalancing

- Tax-loss harvesting

- Diversification

- Automatic investing

According to Statista (2024), robo-advisors managed over $2.6 trillion globally, showing increasing investor confidence in automation.

Why AI Is Revolutionizing Wealth Management 🤯

AI brings several advantages to portfolio management:

1. Data-Driven Decisions

AI can process millions of data points to identify market trends and optimize investment strategies in real time (Chen et al., 2022).

2. Lower Fees

Traditional financial advisors charge 1–2% in management fees. In contrast, robo-advisors typically charge around 0.25%–0.50%, making investing more accessible (Betterment, 2023).

3. Reduced Emotional Bias

AI eliminates emotional trading, which often leads to poor decisions. Automated systems stick to long-term strategies, regardless of market noise (Lo, 2017).

For more information visit: https://www.youtube.com/watch?v=P8sfMoR1OOs

Pros and Cons of Using Robo-Advisors ⚖️

✅ Pros

- Affordable investment management

- Easy account setup and maintenance

- Round-the-clock accessibility

- Low minimum investment requirements

❌ Cons

- Limited human interaction

- Less customization for complex financial needs

- Dependence on historical data

While great for beginners and passive investors, high-net-worth individuals may still prefer hybrid or human-managed solutions for tailored advice.

Are Robo-Advisors Safe and Reliable? 🔒

Security is a major concern when it comes to AI-based financial tools. Fortunately, most platforms use bank-level encryption, two-factor authentication, and SIPC insurance for brokerage accounts.

However, robo-advisors are not immune to market volatility. While they follow intelligent strategies, your portfolio can still experience losses based on market conditions.

The Future of Robo-Advisors 🔮

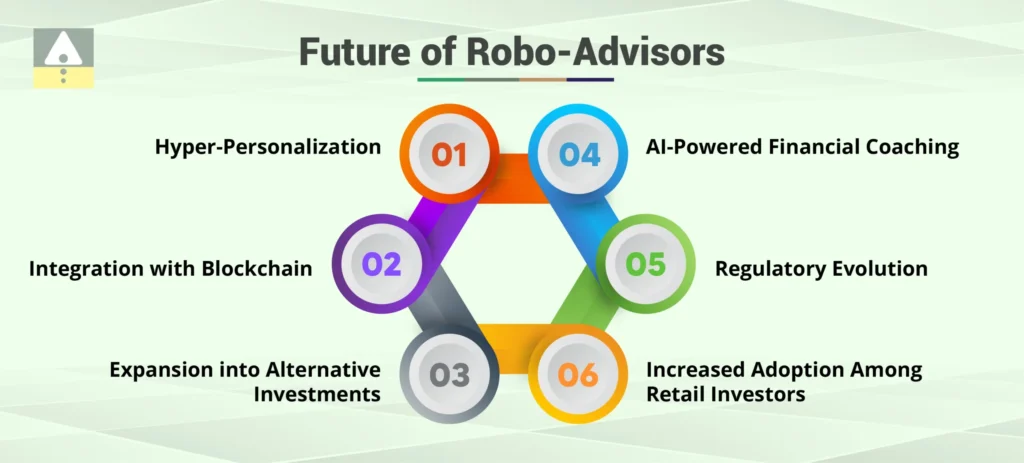

The robo-advisory landscape is rapidly evolving. Emerging technologies like machine learning, natural language processing, and blockchain integration are shaping next-gen platforms.

Some trends to watch:

- Voice-activated financial planning

- Hyper-personalized portfolios

- Integration with digital banks and fintech apps

Experts predict that by 2030, robo-advisors could manage over 30% of global investable assets (PwC, 2023).

Conclusion: Are Robo-Advisors the Future of Wealth Building? ✅

AI-powered robo-advisors are transforming the investment world by making wealth building more efficient, affordable, and accessible. While they may not fully replace traditional advisors, especially for complex cases, their role in modern finance is undeniable.

For most people—especially young investors, tech-savvy users, and those looking for low-cost solutions—robo-advisors are not just the future, they are the present.

Read more:https://wealthfitlife.com/what-if-you-only-made-one-investment-decision-per-year/

Top 10 FAQs: Robo-Advisors, AI Investing, Wealth Management 🤔

1. What is a robo-advisor?

A robo-advisor is an automated platform that uses AI to create and manage investment portfolios.

2. Are robo-advisors good for beginners?

Yes, they are ideal for beginners due to low fees, simplicity, and automated guidance.

3. Do robo-advisors outperform human advisors?

Not always, but they often perform comparably with fewer fees.

4. Are robo-advisors safe to use?

Yes, most use strong encryption and are regulated by financial authorities.

5. How much money do I need to start?

Many platforms allow you to start with as little as $100.

6. Can robo-advisors handle retirement planning?

Yes, many offer IRA accounts and long-term goal setting.

7. How do robo-advisors choose investments?

They use algorithms to select ETFs and rebalance portfolios based on risk profiles.

8. Are the fees worth it?

Absolutely, especially compared to traditional advisors’ higher fees.

9. Can I talk to a human advisor if needed?

Some platforms offer hybrid services with human support.

10. What is the best robo-advisor in 2025?

This varies by need, but Betterment, Wealthfront, and SoFi are leading platforms.

References

- Betterment. (2023). Pricing and Plans. Retrieved from https://www.betterment.com

- Chen, Z., Li, X., & Wu, D. (2022). AI Applications in Financial Investment. Journal of Financial Technology, 10(4), 120-138.

- Lo, A. W. (2017). Adaptive Markets: Financial Evolution at the Speed of Thought. Princeton University Press.

- PwC. (2023). Asset and Wealth Management Revolution 2023. Retrieved from https://www.pwc.com

- Statista. (2024). Assets under management of robo-advisors worldwide. Retrieved from https://www.statista.com