Small Cap vs Mid Cap vs Large Cap: Which One Should You Pick in India?

A Complete Guide for Indian Investors to Understand Market Capitalization Categories

Introduction

When it comes to investing in the Indian stock market, one of the most common dilemmas investors face is:

“Should I invest in small cap, mid cap, or large cap stocks?”

Understanding the difference between these categories isn’t just helpful—it’s crucial. The size of a company (based on market capitalization) can affect everything from returns and risk to liquidity and growth potential.

In this blog, we’ll explore:

- Definitions and examples of small, mid, and large cap stocks in India

- Their risk-return profiles

- Real-world performance data

- Academic insights on diversification

- And most importantly—which one should you pick based on your goals.

What Is Market Capitalization?

Market Capitalization = Share Price × Number of Outstanding Shares

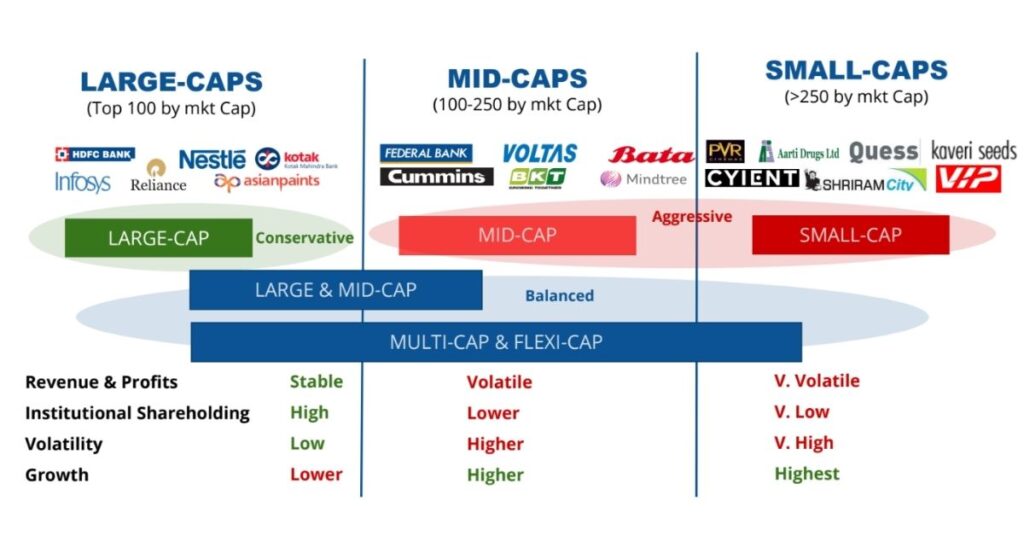

In India, SEBI (Securities and Exchange Board of India) has classified stocks based on their market capitalization as follows (SEBI, 2017):

| Category | Market Cap Range (₹ Cr) | Approx. Rank by Market Cap |

|---|---|---|

| Large Cap | ₹20,000 Cr and above | Top 100 companies |

| Mid Cap | ₹5,000 Cr – ₹20,000 Cr | 101st to 250th companies |

| Small Cap | Below ₹5,000 Cr | 251st and onwards |

Large Cap Stocks: The Giants

✅ Characteristics:

- Established companies with stable earnings

- Lower volatility

- High liquidity

- Regular dividends

🧠 Examples:

- Reliance Industries

- Infosys

- HDFC Bank

📈 Who Should Invest:

- Conservative investors

- Long-term players who want stability over aggressive growth

📚 Academic Insight:

A study published in the Journal of Financial Economics (Fama & French, 1993) showed that larger companies tend to have lower average returns but lower risk, supporting the notion that large cap investing is suited for capital preservation.

Mid Cap Stocks: The Climbers

✅ Characteristics:

- Growing companies with decent financials

- More volatile than large caps

- Higher return potential

🧠 Examples:

- Bharat Forge

- Persistent Systems

- Page Industries

📈 Who Should Invest:

- Investors with moderate risk tolerance

- Those seeking a balance between growth and stability

📚 Research Note:

According to a 2020 study in the Indian Journal of Finance, mid cap funds in India have historically outperformed large caps in bull markets while underperforming during bear cycles.

Small Cap Stocks: The Sprinters (or Stumblers)

✅ Characteristics:

- Young or relatively unknown companies

- High risk, high return

- Low liquidity

- Prone to sharp price swings

🧠 Examples:

- Brightcom Group

- Tanla Platforms

- Tasty Bite Eatables

📈 Who Should Invest:

- Aggressive investors

- Those with a high-risk appetite and long investment horizon

📚 Academic Insight:

The “Small Firm Effect”, as proposed by Banz (1981) in the Journal of Financial Economics, suggests that small cap stocks tend to offer higher returns over the long run—but with much higher volatility.

Performance Comparison: 5-Year CAGR (as of 2024)

| Index | 5-Year CAGR | Volatility (Std Dev) |

|---|---|---|

| Nifty 50 (Large Cap) | ~11% | Low |

| Nifty Midcap 150 | ~15% | Moderate |

| Nifty Smallcap 250 | ~17–18% | High |

Source: NSE India, Morningstar (2024 data)

Risk vs Return: What You Must Understand

| Factor | Large Cap | Mid Cap | Small Cap |

|---|---|---|---|

| Return Potential | Moderate | High | Very High |

| Risk Level | Low | Medium | Very High |

| Liquidity | Very High | High | Low |

| Volatility | Low | Moderate | High |

| Suitable For | Conservative | Balanced | Aggressive |

Which One Should You Pick?

Here’s how you can decide based on your investor profile:

| Investor Type | Ideal Cap Mix (Suggested %) |

|---|---|

| Beginner / Conservative | 70% Large, 20% Mid, 10% Small |

| Balanced Risk Taker | 40% Large, 40% Mid, 20% Small |

| Aggressive Growth Seeker | 20% Large, 30% Mid, 50% Small |

Pro Tip: Rebalance your portfolio every 6–12 months and monitor fundamentals, not just hype.

Conclusion

In the dynamic landscape of Indian equity markets, there’s no “one-size-fits-all” answer to whether small, mid, or large cap stocks are best.

Each has its place and purpose.

The key lies in understanding your risk profile, investment horizon, and financial goals.

By diversifying across all three, you can create a robust and resilient portfolio that captures growth while managing risk.

Read More:https://wealthfitlife.com/what-are-nifty-sensex-a-simple-guide-for-investors/

FAQs: Small Cap vs Mid Cap vs Large Cap in India

- What is the main difference between small, mid, and large cap stocks?

➤ The classification is based on market capitalization, with large caps being the biggest companies and small caps the smallest. - Which category has the highest return potential?

➤ Small caps, but they come with the highest risk. - Are small cap stocks safe?

➤ Not entirely. They are volatile and can be risky if not researched properly. - Should I only invest in large cap stocks?

➤ If you’re risk-averse, yes. But diversification across all caps is often more effective. - Can I invest in these through mutual funds?

➤ Absolutely. Many AMCs offer large cap, mid cap, and small cap funds in India. - How often should I review my cap allocation?

➤ At least every 6–12 months or during major market shifts. - Do small caps perform better in bull markets?

➤ Yes, historically, they tend to outperform during bull runs. - Are mid caps good for long-term investment?

➤ Yes, they strike a balance between risk and reward. - How do I know the market cap of a stock?

➤ You can check it on NSE/BSE websites or financial platforms like Moneycontrol and Zerodha. - Is it okay to invest only in small caps for high returns?

➤ It’s risky. Always balance with mid and large caps to manage downside.