Are Index Funds Still the GOAT in 2025? 🏆📈

In the ever-evolving world of investing, one question remains pertinent: are index funds still the Greatest Of All Time (GOAT) in 2025? Let’s delve into why these passive investment vehicles continue to dominate, even amidst market fluctuations and economic uncertainties.

What Are Index Funds? 🤔

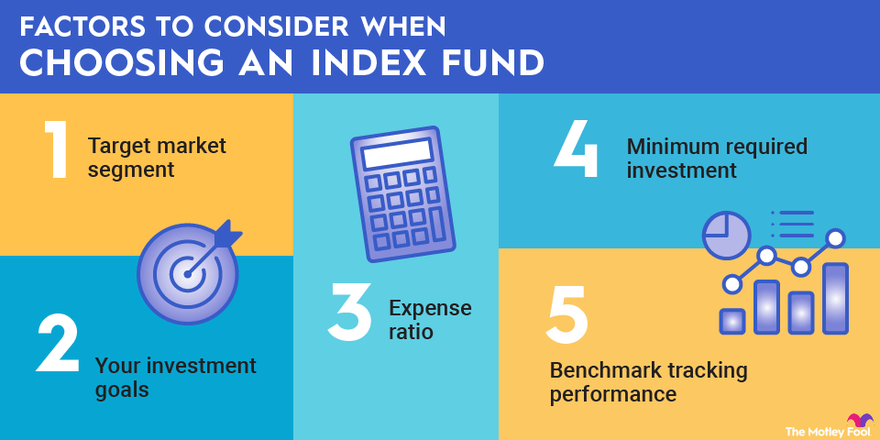

Index funds are investment funds designed to replicate the performance of a specific market index, such as the S&P 500. Unlike actively managed funds, which rely on fund managers to pick stocks, index funds automatically invest in the same securities that constitute the chosen index, offering broad market exposure, low operating expenses, and low portfolio turnover.

Why Index Funds Remain the GOAT in 2025 🥇

1. Consistent Performance Over Time

Despite market volatility, index funds have demonstrated resilience. For instance, the Vanguard S&P 500 ETF (VOO) has shown a 5-year average annual return of 11.8%, reflecting the steady growth of the U.S. stock market .

2. Low Fees = Higher Returns 💸

One of the primary advantages of index funds is their low expense ratios. VOO, for example, boasts an expense ratio of just 0.03%, allowing investors to retain more of their returns compared to higher-fee actively managed funds .

3. Diversification Made Easy 🌍

Index funds provide instant diversification by investing in a broad array of securities. This diversification helps mitigate risks associated with individual stocks, making them an attractive option for long-term investors.

4. Tax Efficiency 📊

Due to their passive nature, index funds typically generate fewer taxable events than actively managed funds. This tax efficiency can result in higher after-tax returns for investors .

5. Ideal for Beginners 👶

For new investors, index funds offer a straightforward and effective way to enter the market. Their simplicity, combined with historical performance, makes them a go-to choice for those starting their investment journey .

Top Index Funds to Consider in 2025 🔝

Here are some of the leading index funds making waves this year:

- Vanguard S&P 500 ETF (VOO): Tracks the S&P 500, offering exposure to 500 of the largest U.S. companies with a low expense ratio of 0.03% .

- iShares Core MSCI Emerging Markets ETF (IEMG): Provides broad exposure to emerging market stocks across Asia, Latin America, and other developing regions, with an expense ratio of 0.09% .

- Vanguard Russell 1000 Growth ETF (VONG): Focuses on growth stocks within the Russell 1000 index, emphasizing sectors like technology and consumer discretionary .

Navigating Market Volatility in 2025 📉📈

The onset of geopolitical tensions and trade wars, such as the recent U.S.-China trade disputes, has introduced new challenges for investors. However, index funds have shown resilience during such periods. For instance, during the 2024 market downturn, funds like the Vanguard S&P 500 Growth ETF (VOOG) outperformed the broader market, highlighting the potential of sector-specific index funds during volatile times .

Conclusion: The Enduring Appeal of Index Funds 🏁

In 2025, index funds continue to be a cornerstone of investment strategies. Their consistent performance, low fees, diversification benefits, tax efficiency, and suitability for beginners solidify their status as the GOAT of investing. While market conditions will always fluctuate, the fundamental advantages of index funds remain steadfast.

Read more:https://wealthfitlife.com/why-time-in-the-market-beats-timing-the-market/

Frequently Asked Questions (FAQs) ❓

- What is an index fund?

- An index fund is a type of mutual fund or ETF designed to replicate the performance of a specific market index, such as the S&P 500.

- Why are index funds considered low-cost investments?

- Index funds are passively managed, meaning they require less research and fewer transactions, leading to lower management fees.

- Can I invest in index funds through a retirement account?

- Yes, many retirement accounts, like IRAs and 401(k)s, offer index fund options.

- Are index funds risk-free?

- While they offer diversification, index funds are still subject to market risks and can fluctuate in value.

- How do index funds compare to actively managed funds?

- Index funds typically have lower fees and have historically outperformed actively managed funds over the long term.

- Can I invest in international markets through index funds?

- Yes, there are index funds that track international markets, providing global diversification.

- What is the minimum investment required for index funds?

- The minimum investment varies by fund, but many have low or no minimum investment requirements.

- How do I purchase index funds?

- Index funds can be purchased through brokerage accounts, retirement accounts, or directly from fund providers.

- Do index funds pay dividends?

- Many index funds pay dividends, which can be reinvested or taken as income.

- Are index funds suitable for long-term investing?

- Yes, index funds are ideal for long-term investors due to their diversification and historical performance.

References 📚

- Forbes. (2025). 5 Top Index Funds To Buy For 2025: March Edition. Retrieved from https://www.forbes.com/sites/investor-hub/article/best-index-funds-2025/

- Toxigon. (2025). Why Index Funds Are a Great Choice for New Investors in 2025. Retrieved from https://toxigon.com/why-index-funds-are-a-great-choice-for-new-investors

- Toxigon. (2025). Best Index Funds 2025: Top Picks and Strategies for Smart Investing. Retrieved from https://toxigon.com/best-index-funds-2025

- Toxigon. (2025). Investing in Index Funds: A Beginner’s Guide for 2025. Retrieved from https://toxigon.com/investing-in-index-funds-a-beginners-guide-2025

- The Motley Fool. (2025). Prediction: The 2 Best Vanguard Index Funds of 2024 Will Beat the S&P 500 Again in 2025. Retrieved from https://www.fool.com/investing/2025/01/06/2-best-vanguard-index-funds-2024-beat-sp-500-2025/

- Kiplinger. (2025). Two Don’ts and Four Dos During Trump’s Trade War. Retrieved from https://www.kiplinger.com